[11/11/2025: Some card offers have since expired.]

There’s A LOT of elevated offers right now! And while it’s never a bad time to plan a trip, it’s a great time to plan Umrah travel on points and miles. You have options, which is just what you need when planning a trip with multiple layers to it. I booked an Umrah trip for my family last fall for just $500 out-of-pocket – it’s definitely possible to not have to spend thousands of dollars!

[Related: Check out all the current best card offers here.]

But First, Flights

I generally always book flights first for any trip (while scouting hotel award availability). We are 5, and getting even economy award seats – during peak travel times – is a challenge. Questions to ask yourself:

- Do I live in any airline hubs?

- Will that airline help me get to my destination?

- Do I need to book a positioning flight?

[Related: Positioning Flights: Things To Consider]

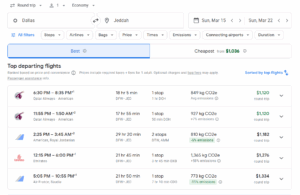

Let’s look at flight options from my home city of Dallas, Texas. (Google won’t allow me to search past a certain point into 2026, so I’m doing a dummy search for spring break time, 2026, as that tends to be a popular time for Umrah travel.)

Now I live in a Southwest Airlines and American Airlines hub, so I have options. But if you don’t live in a major city, like Chicago, New York, or Dallas, for example, you may need to take a positioning flight into one of these cities. You’ll tend to find more routes and flight options from bigger cities. (This of course depends on what route you choose to take, and what city you live in. You may not need to take a positioning flight if you find a route that works for you, from your hometown airport.) *Depending on the timing of your travel, and your departure airport, you’ll notice similar options from other major cities, as well as different ones not displayed here.*

For example, I often use Southwest Airlines (Hello two Companion Passes!) to fly my family to New York, when our final destination is Europe. I’m doing this twice for upcoming fall and winter travel.

Southwest Elevated Offers

Southwest Airlines currently has elevated offers of 100K bonus points on all 3 of its personal cards. Yes, I know what you’re thinking. Southwest Airlines isn’t going to take me very far when it comes to Umrah travel. Correct. But they can help you book a positioning flight if need be. If you don’t live in a Southwest Airlines hub, don’t fly the airline often, and/or aren’t a fan of the airline currently (I don’t blame you) then yes, definitely feel free to look past these offers.

Here are the elevated card offers:

Southwest Rapid Rewards Plus Credit Card ($99 Annual Fee)

Southwest Rapid Rewards Premier Credit Card ($149 Annual Fee)

Southwest Rapid Rewards Priority Credit Card ($229 Annual Fee)

Things To Consider:

- The annual fees on each of these cards have gone up, with multiple changes to perks and benefits.

- Southwest Airlines no longer allows free checked bags.

- Southwest card holders get one free checked bag.

That being said, it’s generally always worth it to keep a card for the first year because of the bonus points offer you receive. Unfortunately, Southwest Airlines doesn’t offer no-fee card options. So in this case, after a year, you would need to cancel your card if you no longer find value from it. (Always hold a card for the first year. Afterwards, you can downgrade it to a no-fee option if you no longer find value. Downgrading a card is generally always better than cancelling a card outright.)

Elevated Offers On Cards That Earn American Airlines Miles

You’ll notice in my search that there are routes on airlines that are partners of American Airlines. You can book these flights with partners or with American Airlines directly. (You’ll find searching and booking on American Airlines definitely easier!)

For last fall’s Umrah trip, I booked flights directly on American Airlines. I found roundtrip flights from Dallas to Istanbul, Turkey for 45k American Airlines miles/per person. I would happily fly the airline again for Umrah travel. Ideally though, I would book a route that takes me from Dallas to Doha.

[Related: How I booked Umrah travel for $500]

Here are some card offers that can help you earn American Airlines miles:

Citi American Airlines AAdvantage Platinum Select World Elite Mastercard – Limited-Time Offer to earn 80,000 miles after spending $3,500 in the first 4 months. Annual fee is $99, and is waived for the first 12 months. (This one, along with the business version of this card, tend to be the best options as they often have elevated offers.)

You can check out the full suite of co-branded Citi and American Airlines cards here.

AAdvantage Aviator Red World Elite Mastercard – Earn 50,000 AAdvantage bonus miles after making your first purchase and paying the $99 annual fee in full, both within the first 90 days. Annual fee is $99. It doesn’t get easier than this card to earn American Airline miles! (This is not an elevated card offer. I’m sharing it as it’s an easy way to earn more of these miles!)

Citi Strata Elite Card – Earn 80,000 bonus points after spending $4,000 in the first 3 months. The annual fee is $595. This is a new premier travel card on the market, and can be a good option since Citi ThankYou points are now transferable to American Airlines.

Citi Strata Premier Card – Earn 60,000 bonus points after spending $4,000 in the first 3 months. Annual fee is $95. Again, this is another Citi card option, with a lower annual fee, to help you earn points that can transfer to American Airlines.

Chase Bank Elevated Card Offers

Chase currently has 3 elevated card offers, including one brand-new business card.

Chase Sapphire Preferred – Earn 75,000 bonus points after spending $5,000 bonus points in the first 3 months. Annual fee is $95. This is one card that’s a great card to start with when it comes to points and miles. It’s also a keeper so you have a means to transfer your Chase points out to airline and hotel partners, and redeem for travel. (You need a Sapphire product in order to be able to do so.)

Chase Sapphire Reserve – Earn 125,000 points after spending $6,000 in the first 3 months from account opening. The annual fee is now increased to $795 on this card, and it’s an additional $195 for each authorized user.

Chase Sapphire Reserve for Business – Earn 200,000 bonus points after spending $30,000 on purchases in your first 6 months from account opening. The annual fee is $795 on this card. This is a brand new addition to Chase’s business card lineup. If you can meet the minimum spend on this card, this can be a great offer for you.

You can check out more business card options here from Chase bank, including ones with no annual fees.

[Related: Why You Need Business Cards In Your Award Travel Strategy]

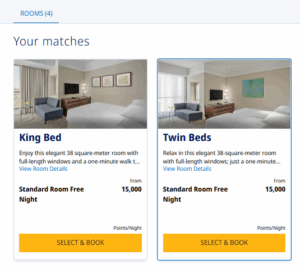

A great way to use Chase points for Umrah travel is to transfer them to World of Hyatt to book a stay at Jabal Omar Hyatt Regency Makkah. We stayed here for 2 nights in November of 2024, and we had 2 rooms. It cost me 9k points/room/night for a total of 36k points. Our total out-of-pocket cost was $0, as Hyatt doesn’t charge taxes and fees on award stays.

While nightly award rates have gone up since then, one of these high offers can easily help you cover a couple nights. Do double check room capacity with the hotel directly. I had to book 2 rooms as there were 4 of us, and my kids were 15 and 11 at the time. I have heard from others, with younger kids, that they only needed to book one room with two beds. (Shown below is room availability for April 2026.)

Transferring your Chase points to World of Hyatt is always a great value! Chase has a total of 14 airline and hotel travel partners that you can transfer your points to and redeem for travel.

American Express Elevated Card Offers

American Express Gold Card – You may be eligible for as high as 100,000 Membership Rewards Points after you spend $6,000 in the first 6 months. Annual fee is $325.

The Platinum Card from American Express – You could be eligible for as high as 175,000 Membership Rewards Points after spending $8,000 in eligible purchases in the first 6 months. Annual fee is $695.

*Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved, and find out your exact welcome offer amount – all with no credit score impact.*

Note that American Express and Chase points both transfer to Flying Blue, the loyalty program of KLM/Air France, one flight option shown above in my search.

Additional Card Offers To Keep In Mind For Umrah Travel

Capital One is my second favorite bank after Chase bank to earn points from. While not ideal, I like to use Capital One miles to help cover additional travel-related expenses that can’t always be booked directly in points and miles. (Think train tickets, boutique hotel stays, transportation, flights, and car rentals, for example.)

These card offers are currently not elevated, but great to keep in mind for Umrah travel. Here are the best Capital One card options with this perk:

Capital One Venture Rewards Credit Card – Annual Fee is $395

Capital One Venture X Credit Card – Annual Fee is $95

Both card offers are for 75k bonus miles after spending $4,000 in the first 3 months.

I used Capital One miles to cover our one-way train ride from Makkah to Madinah, our one-way flights from Istanbul to Jeddah, and then Madinah back to Istanbul, as well as our hotel stay in Madinah. I actually booked both sets of one-way flights in the Capital One travel portal (and earned 10x back on them). I later used miles to cover both sets of flights in full.

[Related: How Capital One miles saved me just under $3,000 for Umrah travel]

Again, the best way to use flexible points from any bank will be to transfer them to airline and hotel travel partners, and redeem for travel. This will generally always give you the maximum value for your points. But if it helps you save money on travel expenses, even if it’s a less-than-ideal method, you’re still winning at this game!

In Sum

These are just some great card options to consider if you’re planning a future Umrah trip. I highly suggest planning 12-18 months out, especially if you are traveling with multiple people, and/or will be traveling during peak travel times.

Umrah Doesn’t Need To Cost Thousands of Dollars

It’s possible to book an Umrah trip on points and miles, as you would any other trip. Yes, it can be a bit more challenging but it’s certainly possible. And I’m here to show you how it’s done!

Umrah is achievable for thousands of dollars less!

For more in-depth information, check out A Guide to Umrah on Points & Miles that I’ve created that walks you through:

- How to search for award flight availability (economy seats) from the U.S., on popular routes to Jeddah & Madinah

- How to search for award flight availability on partner airlines for airlines in the same airline alliance, with video walkthroughs on both

- How to book hotel stays on points, in the 4 major hotel loyalty programs

- What cards are best for hotel stays & flights, as well as thinking through card lifecycles

- How to cover other travel-related costs (such as transportation between the 2 holy cities) that isn’t booked directly using points/miles (like airfare & hotel stays)

- What “free breakfast” means in each of the major hotel loyalty programs, and how to get that perk

- How to stay organized in award travel with the TravelFreely App

I’ve also spent thousands of dollars to go to Umrah with my family, and I know the feeling of planning and saving up. With points and miles, the journey is closer and more attainable than you think.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all questions are answered.

Leave a Reply Cancel reply

ADVERTISER DISCLAIMER

HassansonHoliday operates within an affiliate sales network and may earn compensation for directing traffic to partner sites, such as MileValue.com. The arrangement of links on this site may be influenced by this compensation. Please note that not all financial companies or offers may be featured on this site. Terms and conditions apply to American Express benefits and offers, and enrollment may be necessary for certain benefits. Visit americanexpress.com to learn more. For Capital One products mentioned on this page, some benefits are facilitated by Visa or Mastercard and may vary depending on the product. Refer to the respective Guide to Benefits for specific details, as terms and exclusions apply.

EDITORIAL DISCLAIMER

The opinions expressed on this site are solely those of the author and do not reflect the views of any bank, credit card issuer, hotel, airline, or other entity. This content has not been endorsed, reviewed, or approved by any of the entities mentioned. Paragraph