[Edited 9/10/2024. Please note that card offers do fluctate from time to time.]

Last year, I downgraded my husband’s Chase Sapphire Reserve® to a Chase Freedom Flex®. My husband has had the card for a few years, and it was our one premium-level card. We love our Chase Ultimate Rewards, but there was now a more feasible option for this type of card: the Capital One Venture X Rewards Credit Card.

Why We Switched Cards

The Chase Sapphire Reserve comes with an annual fee of $550. As someone who kept the card for good reason, I know the benefits we received more than made up for the fee. When Capital One came out with its own premium-level card, the Venture X, I knew I had to take time to compare. Annual fee was definitely the deciding factor. The Venture X annual fee is $395/year with comparable benefits to the Reserve. So it came out the winner as the premium travel credit card for us.

Overview Of Card Benefits

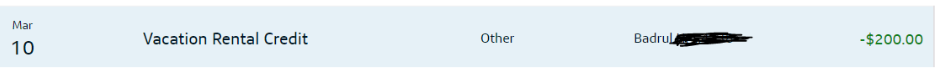

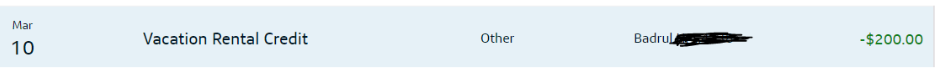

I had my husband apply for the Capital One Venture X when the bonus offer was at 100,000 points, back in December of 2021. At that time, it also came with a vacation rental of $200. The timing couldn’t have been better. We applied the credit towards our AirBnB stay the following year, during our Costa Rica trip in March of 2022. I used the points earned from that offer to book our family a trip to the U.K. this past March. Not only did we earn the initial card bonus, we earned referral bonuses. It takes a lot of points to find five award tickets to well, anywhere!

Here’s what you’ll get with the current Capital One Venture X credit card offer:

- 75,000 miles after you spend $4,000 in first 3 months

- $300 annual travel credit

- up to $120 statement credit on Global Entry or TSA PreCheck

- 10,000 miles anniversary bonus

- 10x miles on hotels & rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on other purchases, every day (keeps it simple!)

- No foreign transaction fees

Lounge Access

Capital One currently has two lounges open: one in Dallas-Fort Worth International Airport (DFW), and one in Dulles International Airport (IAD). There’s one more set to open later this year in Denver International Airport (DEN) . You get unlimited access to the Capital One Lounges for you, and (up to) four authorized users. You can take two guests with you for free, and each guest thereafter will cost you $45. This perk is also extended to authorized users on the card. In addition, Capital One Venture X gives you access to their Partner Lounge Network which includes Priority Pass and Plaza Premium Lounges worldwide.

Capital One Lounge at DFW

I’ve visited a few times and I have to say it’s hands down, my favorite (domestic) lounge to be in. They have multiple food, drink, and dessert options, a shower suite, nursing room, cycling & yoga room, and what I really appreciate – the multi-faith room. I’m so fortunate that the first of the Capital One Lounges opened in my hometown! As an avid Muslim traveler, it’s nice to be able to pray in a clean, secluded, and private area in the airport. (Check out my reel on Instagram that shares more about these spaces.)

Covering Other Travel-Related Purchases

This perk has been essential in helping our family cover other travel-related costs. In December of 2022, I used Capital One miles to cover hotel taxes for our stay in Morocco. In February of 2023, the 10,000 anniversary miles helped cover transportation from the Cancun airport to our hotel in Tulum, and vice versa. In early June, I used miles to cover our ride-sharing costs that we had incurred in Lisbon. And now, I’m covering some Lyft charges from my recent girls trip to New York. You have 90 days from the date of purchase, to cover eligible costs. Remember, award travel IS NOT free travel. There are always other costs that arise, especially when traveling with a family.

Other Perks

Capital One has had Capital One Cafes popping up across the country – the goal is to design welcoming spaces where banking meets living. Every August, they tend to have promotions where you can get $1 beverages. You can find a location near you here. It’s a great place to stop if you’re co-working, want to grab a drink, and/or are holding meetings.

Another benefit you receive by being a Capital One Venture X Card holder: a Cultivist Enthusiast level membership (a $240 value), complimentary for six months. This membership gives you and three guests free museum access to select museums around the world. Check out the Cultivist site for more information on entertainment, special access events to museum exhibits, galleries, and more as a Capital One cardholder.

Always Compare Card Benefits

While you’re getting similar benefits on the Venture X, it is important to compare both cards’ perks and benefits. The Chase Sapphire Reserve does offer more when it comes to built-in travel insurance. In addition, the ability to combine points earned from other (no-fee and business) cards just can’t be beat. Chase tends to come out with great offers on both their personal and business cards. You have more opportunities to earn and combine Chase Ultimate Rewards. While both banks give you the ability to transfer to travel partners, it’s important to note that Chase has more domestic options, partnering with several U.S. airlines and major hotel brands. Capital One has a great selection of international travel partners to choose from.

All this being said, it’s important to hold cards that are conducive to your award travel strategy – personal, business, and/or premium level. So after an assessment of both banks and their card offers, the Chase Sapphire Preferred® Card and Capital One Venture X combination stood out to me. You have a great everyday spend card (Preferred), and one you need as a portal to transfer points from this bank to travel partners. You also have one premium travel card (Venture X) with the perks to help you travel better. Win win!

All-Around Best Travel Premium Credit Card

Capital One Venture X came out with a bang. It’s a staple in our wallet, and our go-to premium-level credit card – even two years in. Remember, different cards will serve you different purposes – at the end of the day it’s about strategy. You get all the comparable benefits of the Reserve with the Venture X, but at a lower annual fee. Capital One Venture X is currently a top choice for many avid travelers, and it’s easy to see why. What’s in your wallet?

[Article Picture: Dallas-Fort Worth Lounge, Picture Source: Capital One]

[…] We are using the points earned from this card to fly to Europe next spring break – read more here as to why we love this card so […]