Three Banks, One Airline Partner: Portugal, Here We Come!

September 25, 2022

[Edited 9/10/2024: Card products and offerings have changed since the post was written.]

After months of planning and scouting deals, I finally booked our trip to Portugal for early summer of 2023. Portugal has been on my immediate bucket list for some time, and I couldn’t be more excited that I was finally able to secure flights for the five of us. Our little one will be 2 in December, so from next year – she’ll count as another full ticket. Finding award availability isn’t always easy when you need multiple seats, but between having flexible rewards currency with multiple banks, and one airline that offered us a sweet award deal – we’re finally heading to Portugal next summer!

AirFrance has a great deal for families: children between the ages of 2-11 receive a 25% discount on award tickets. I wanted to go before the European summer rush started, as well as when the weather was still conducive – and had to keep in mind the kids’ school schedules. Phew! That left me with the end of May – to the beginning of June as an ideal time to make a visit.

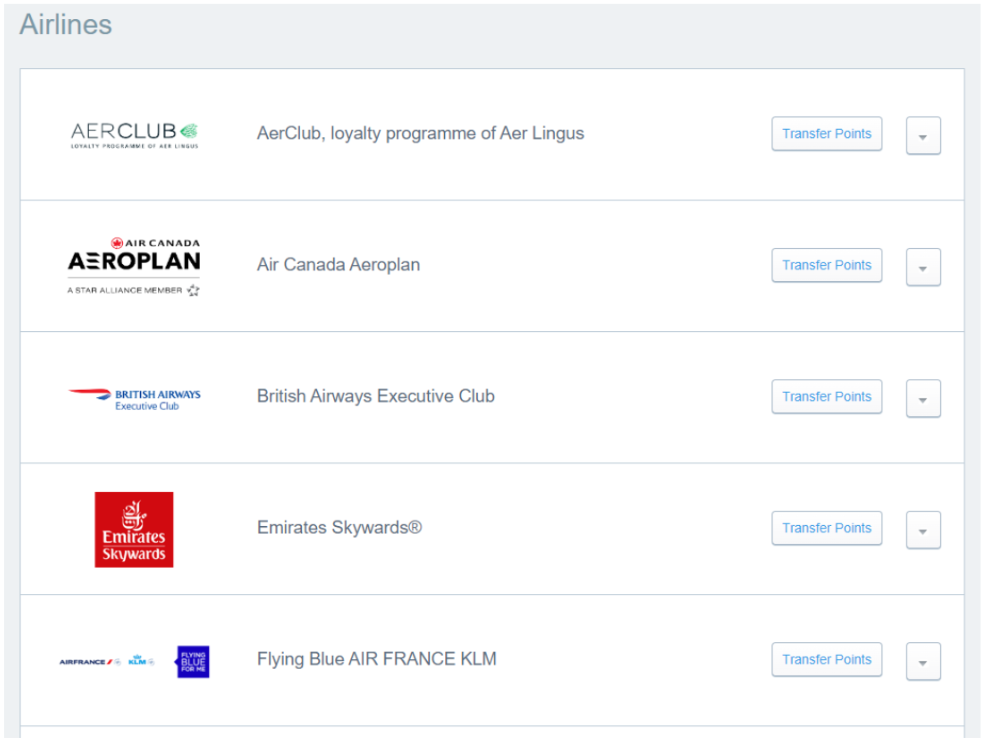

So how did I book this redemption? Luckily, we had points with Citi, Chase, & Capital One – and all three banks have AirFrance as an airline travel partner. But here was the catch – the points earned from different cards were in both our names. How could I streamline this mix of points into one AirFrance account for the final booking? It was chaotic, and there was a learning curve on my part, but I finally made it happen.

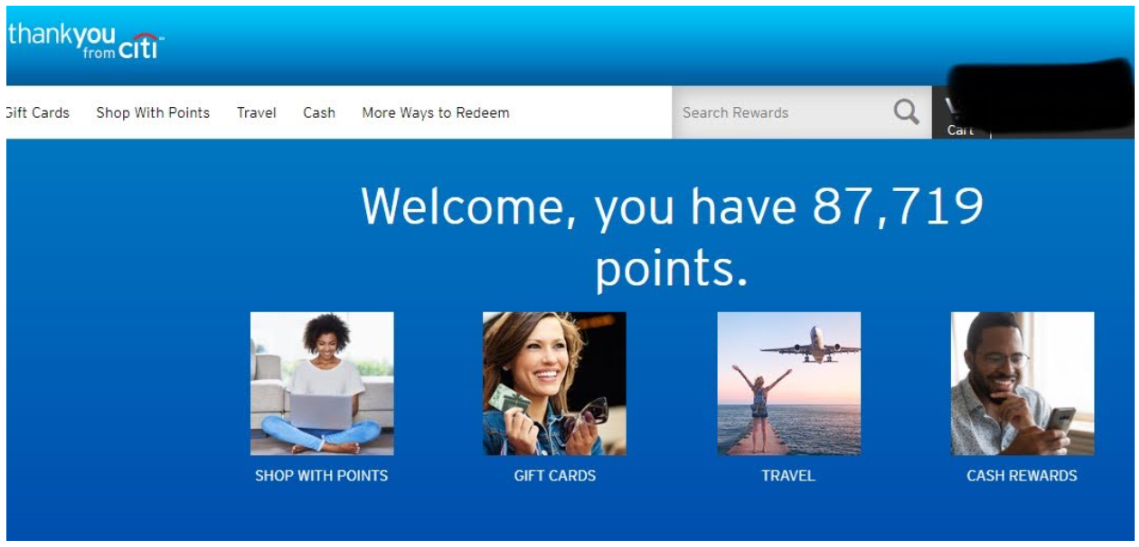

Back in early July of this year, I had applied for the Citi Strata Premier℠ Card – the offer has been at 80,000 points since early June, and after usage, I earned 87,719 Citi ThankYou points.

I also had over 5,300 points that I had earned from my Chase Sapphire Preferred® Card – from regular spend (bills, expenses, dining, miscellaneous charges, etc.) Since neither my husband or I have been working to meet a minimum spend currently, our normal monthly expenses are divided between my Chase Sapphire Preferred Credit Card, and his Capital One Venture X Rewards Credit Card. This way, we continue to earn flexible rewards currency and can transfer to an airline travel partner when needed.

My husband’s Capital One Venture X points balance was 18,592 points. In November, we have a trip coming up where I had to purchase short flights (to/from nearby cities) and pay cash. I purchased them in the Capital One travel portal (because I earn 5x back on flights) and earned close to 6,000 points (the cash price was $1,100 total, for flights for the four of us.) Those points contributed to the total of 18,592 points.

Why do I mention all this? It’s important to understand the benefits of the credit cards you have and use. And rather than getting another credit card, meeting the minimum spend, and earning bonus points that would have helped me book this redemption (possibly) a lot sooner – I knew I’d have enough points if I maximized spend on the cards that we hold currently.

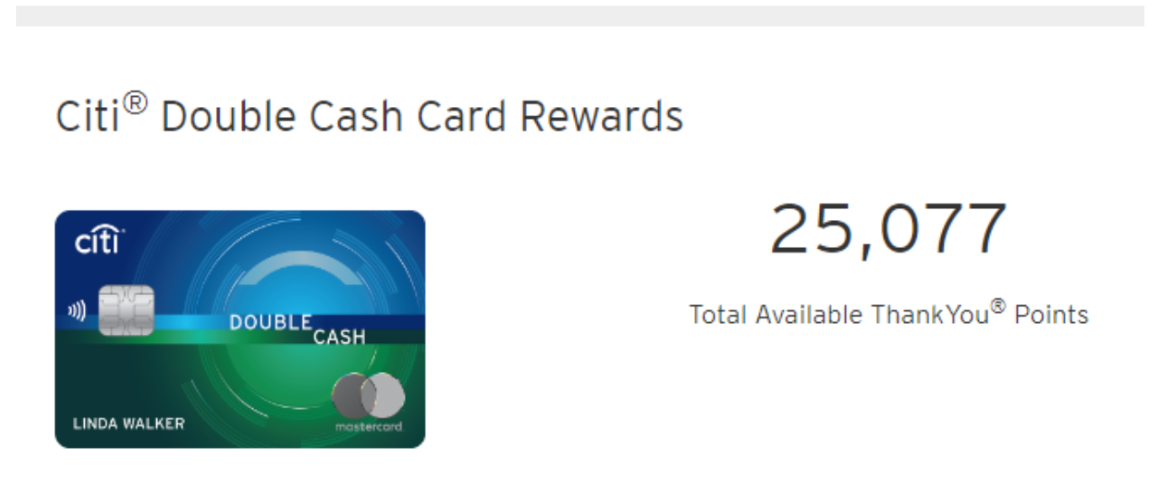

Last month, I had my husband apply for the Citi Double Cash card – with the intention of adding to our stash of Citi ThankYou points. It’s a cash back card, and after spending $1,500 in 6 months, you can earn $200, OR 20,000 Citi ThankYou points (+ points from usage.) Considering he just returned from a week-long work trip last week, between regular spend and work travel expenses – he met that minimum spend rather quickly. If you don’t already have the Citi Premier credit card, I do not necessarily recommend this card.

So what points did we have, and from what cards? Here’s how it looked:

- Chase Sapphire Preferred (Me): 5,304 points

- Citi Premier (Me): 87,719 points

- Capital One Venture X (hubby): 18,592 points

- Citi Double Cash Card (hubby): 25,077 points

That gives us a joint total of 136, 692 points – sweet!

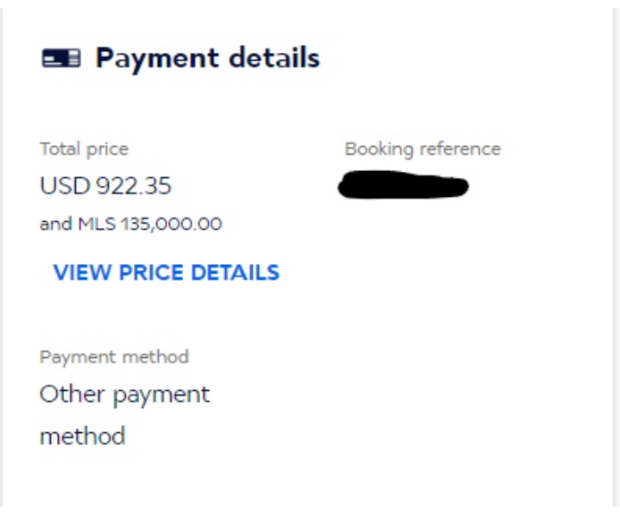

I had been watching deals from New York to Lisbon, Portugal, on AirFrance, for 15k points/one way (30k roundtrip). We would need a total of 135,000 points (30k points x 3 tickets, + 2 discounted tickets at 22.5k points each). We live in DFW, but after searching Google flights early on, and then checking AirFrance routes – the best award deals were either from New York > Lisbon, or Chicago > Lisbon. New York ended up being cheaper, and we want to spend a few days in New York anyway as our older two kids have never been. So from New York to Lisbon it was!

We both have Citi accounts, as well as Chase accounts so I could move the points between the respective accounts as needed – but I don’t have a Capital One account as I currently don’t have any Capital One cards. So I knew the final AirFrance booking had to be from his account (since I needed his stash of Capital One points to help contribute to the final redemption).

Another roadblock: cash back cards don’t have all the same benefits as their other bank counterpart cards. So points earned from my husband’s Citi Double Cash Card, while under his umbrella Citi account, were showing in a different account that didn’t have all the airline/hotel partners as options when compared to our Citi Premier credit card accounts. My husband also has a Chase account – I recently had him downgrade from the Chase Sapphire Reserve® to Chase Freedom Flex®, as we didn’t need two premium-level credit cards. (Capital One is serving as our main premium-level card currently). Same story with Chase Freedom Flex – this account actually did not give me the option at all, to transfer to airline/hotel partners.

Still with me, and the fact that I had to figure out how to get all these points in my husband’s AirFrance account somehow? Here’s how I went about actually doing this:

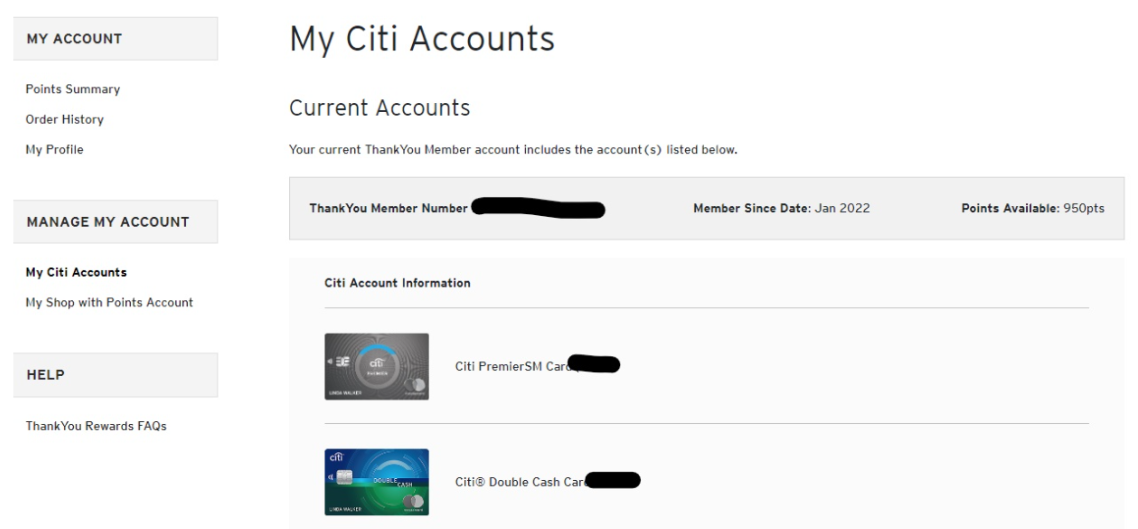

1 – I transferred my Citi ThankYou points to my husband’s Citi ThankYou account. You can transfer a maximum of 100,000 ThankYou points to another ThankYou member, per calendar year. Something to note: shared points expire 90 days after they’re received.

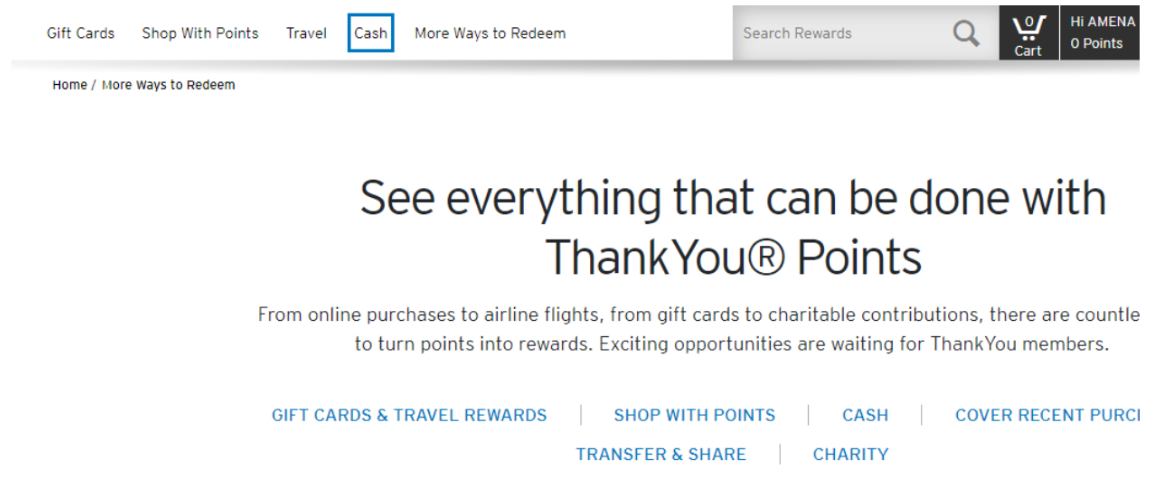

After logging into your Citi account, you will see “more ways to redeem.” After selecting that, there’s an option for “points sharing.” You’ll then put in the ThankYou member’s first and last name, and their account number, and the transfer happens rather instantly!

Also, I had to combine points earned from my husband’s Citi Double Cash Card and Citi Premier Credit Card. When you log into Citi, you’ll see all your cards under one log in – but each card is linked to a separate ThankYou account. I had to make sure all points were under the ThankYou account that was linked to his Citi Premier Card account – as the ThankYou account associated with that card, is the one that has the benefit of transferring points to a travel partner. Again, cashback cards don’t have that option and/or options are limited.

You can combine accounts online, but since he was traveling – I had him call and do this over the phone to help expedite the process. (I was getting asked too many security questions online, and I didn’t want to get locked out of his account.)

On the left side, there’s normally an option to “combine accounts.” In this case, my husband’s two Citi accounts have already been combined under one ThankYou account (so you don’t see that option anymore.)

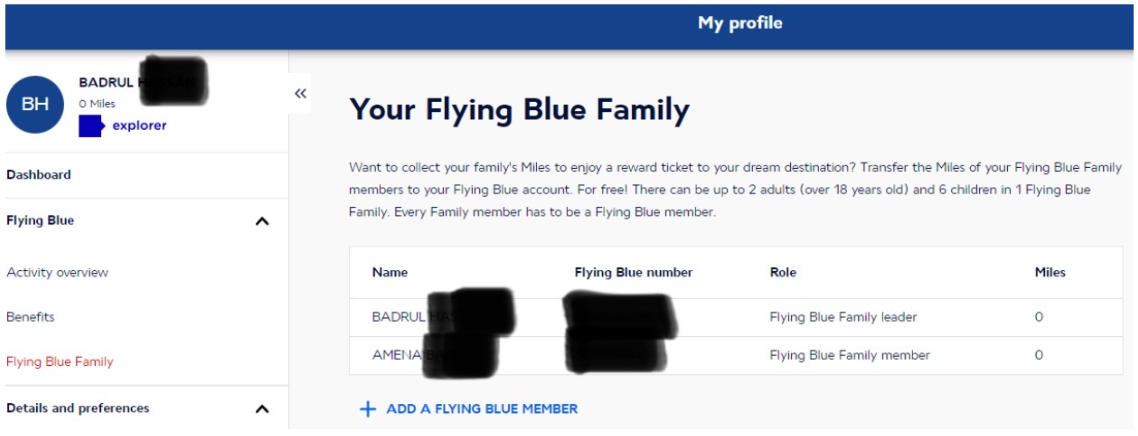

2 – I created a Flying Blue Family within my husband’s Flying Blue account. (FlyingBlue is the award program for AirFrance/KLM). Family accounts are another perk they offer, and it allows you to move miles faster between accounts. You can have up to eight Flying Blue members (maximum 2 adults and 6 children). There is no cost to do so, and the individual who creates the Flying Blue Family becomes the Flying Blue Family “leader.” The leader can then invite another family member to be a part of this family account, and is the only person who can transfer miles between member accounts.

So why did I need to do this? Remember how I had Chase points that I had earned from my Chase Sapphire Preferred card? Well, I couldn’t just move them to my husband’s Chase Freedom Flex card – as that account doesn’t have the benefit of transferring your points to airline/hotel travel partners. So I had to transfer my Chase points to my AirFrance account. Then, on the AirFrance website (since accounts are linked through the Flying Blue Family perk) from my husband’s AirFrance account, he could move over my points into his AirFrance account. Bingo!

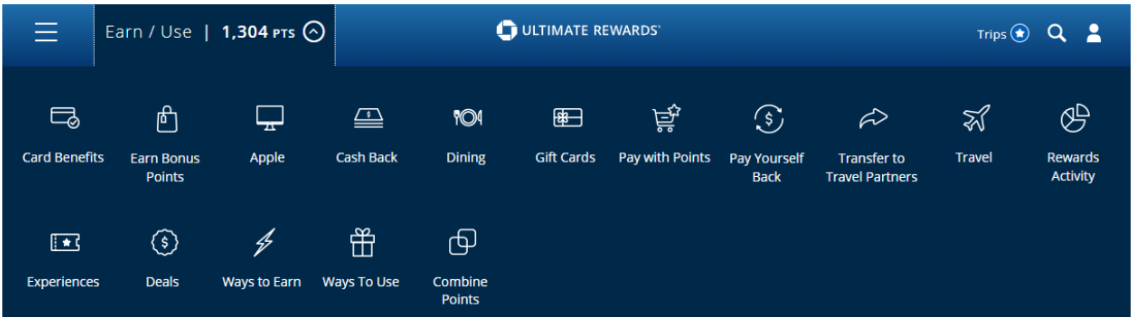

(Chase Ultimate Rewards Homepage – you would select “transfer to travel partners,” and the screen below would pop up with all airline/hotel travel partners. Since this is the homepage linked to my Chase Sapphire Preferred Card, you see the option for “transfer to travel partners.”)

3 – I transferred my husband’s Capital One miles earned from his Capital One Venture X Card directly to his AirFrance account. This was pretty straightforward, and instant as well. When you log into your Capital One account, on the “home” page, you’ll see “convert rewards.” You’ll select that option, and then the next screen will show you the complete list of airline/hotel transfer partners.

Check out the cash rate for flights for the five of us from New York to Lisbon, Portugal:

Here’s the cost in miles and taxes paid:

Taxes were $184.47/person (x 5) – leading to the total of $922.35. Now I’ve definitely seen other routes with less taxes per person. But I had to keep in mind the timing of travel, where I was traveling to/from, and also the number of people in my travel party. Now what about getting to/from New York you ask? Well, I’ll book roundtrip flights on Southwest Airlines in the coming months – after earning the companion pass for 2023 and 2024, we will only need points for four tickets (as opposed to five) – whoo hoo!

Booking award travel at least 6-9 months out is the general rule of thumb. That’s not to say you can’t find award seats otherwise, but the more people in your travel party, the further out you plan – the better. It was a challenge trying to keep track of all the balls in the air, so to speak, but I learned so much! And looking at how much I’ve saved when using points and miles to book travel, makes it all worth it. We wouldn’t be able to travel so often otherwise – I can’t wait to finally visit Portugal next summer with the family!

Picture Credit: ckanani.com

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all questions are answered.

Leave a Reply Cancel reply

ADVERTISER DISCLAIMER

HassansonHoliday operates within an affiliate sales network and may earn compensation for directing traffic to partner sites, such as MileValue.com. The arrangement of links on this site may be influenced by this compensation. Please note that not all financial companies or offers may be featured on this site. Terms and conditions apply to American Express benefits and offers, and enrollment may be necessary for certain benefits. Visit americanexpress.com to learn more. For Capital One products mentioned on this page, some benefits are facilitated by Visa or Mastercard and may vary depending on the product. Refer to the respective Guide to Benefits for specific details, as terms and exclusions apply.

EDITORIAL DISCLAIMER

The opinions expressed on this site are solely those of the author and do not reflect the views of any bank, credit card issuer, hotel, airline, or other entity. This content has not been endorsed, reviewed, or approved by any of the entities mentioned. Paragraph

[…] of planning a cousins’ summer 2023 trip, along with finalizing parts of our spring break and summer 2023 Europe trips. (Planning multiple award travel trips got me like…….) We’ll be staying at […]

[…] recently returned from our spring break trip to the UK…..and are looking forward to our early summer trip to Lisbon, Portugal! It’s always exciting for me to look forward to another family trip – all thanks to […]