It’s no secret that you can earn a good chunk of points from credit card signup bonuses. Now, that’s not to say you need to sign up for every new card that comes out (don’t get “shiny new card syndrome”). With a proper award travel strategy that is inclusive of signup bonus offers, you can certainly enjoy heavily discounted travel. But every so often, there are promotions that don’t require signing up for a new card or account. After completing a specific number of transactions, in a set period of time, you can earn points or cash (also known as bank bonuses).

Overview

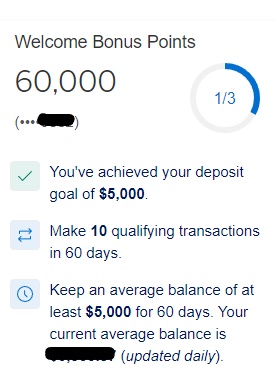

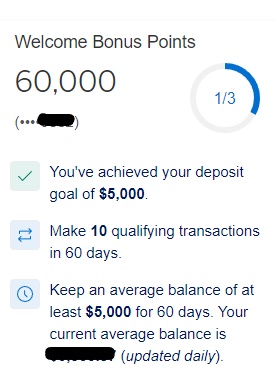

A couple months ago, American Express had a promotional offer for 60,000 American Express Membership Reward points. (This offer is no longer around.) You had to open a business checking account, make a couple transactions for specific amounts, and hold the money in the account for 60 days. After the requirements were complete; 60,000 American Express Membership Reward points would be deposited in the new business checking account.

How Do I Use The Points?

Now, I had no idea how to put these points to good use. We currently do not hold any American Express cards. My preferred cards of choice are cards from Chase Bank (including co-branded ones); my everyday card is the Chase Sapphire Preferred® credit card. It was nice that I could transfer points to one of their airline or hotel travel partners, without holding a physical card from American Express.

I noticed that Delta Airlines was a travel partner of American Express. I had been scouting flights to New York, as I’ve been wanting to plan a proper visit to the Big Apple with the family. I found a deal to New York during my kids fall break in October for 15,000 Delta SkyMiles, roundtrip. For just a month out, it was great to be able to find multiple award seats!

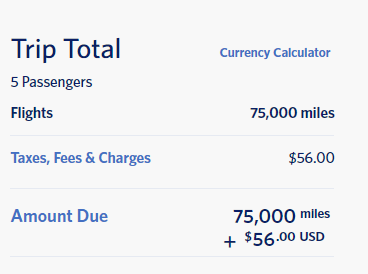

I was able to book 5 award seats, but I’m not going with my family. Instead, we’ll be doing a girls trip for my teenager and I, and my sister-in-law and twin nieces – who will be turning 13 during that trip. And it’s a surprise for the girls! I’m so excited to be able to do this, made possible by points.

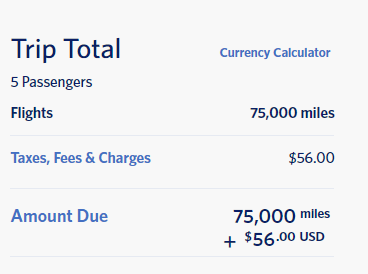

Here’s what I paid:

It cost me 15k miles/roundtrip/person + $11.20 in flight taxes – I’ll take it! I honestly do not focus on always finding the maxium value in my points, as between aligning schedules, booking travel during peak travel times due to kids’ school breaks, and my husband’s PTO – I have enough factors to think about already. And with the recently announced Delta SkyMiles loyalty program changes (aka devaluation), it’s a reminder to not sit on points and miles – from any program – for too long.

Linking Accounts

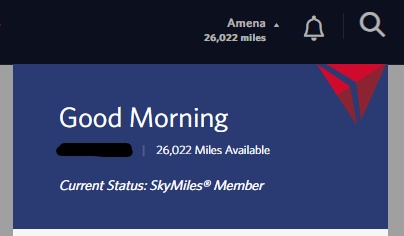

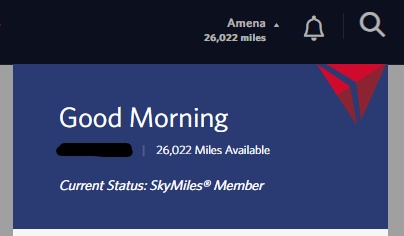

The American Express business account promotional offer was for 60,000 Membership Reward points. I earn points from regular grocery delivery because I linked my Instacart and Delta SkyMiles accounts, so I had a stash of points sitting in my Delta account.

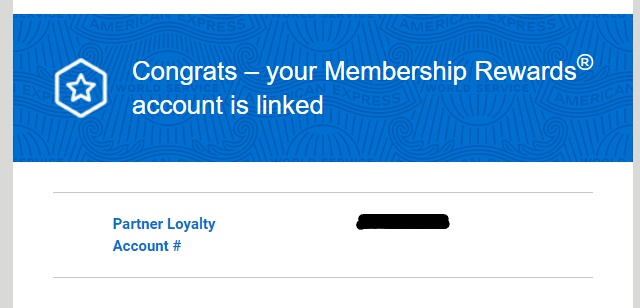

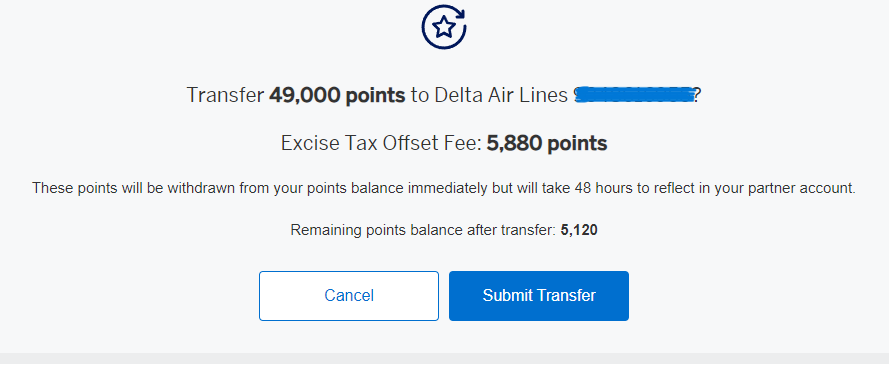

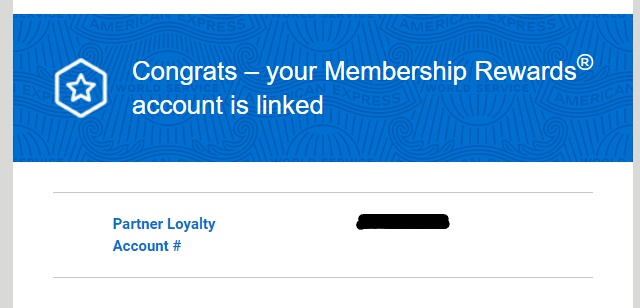

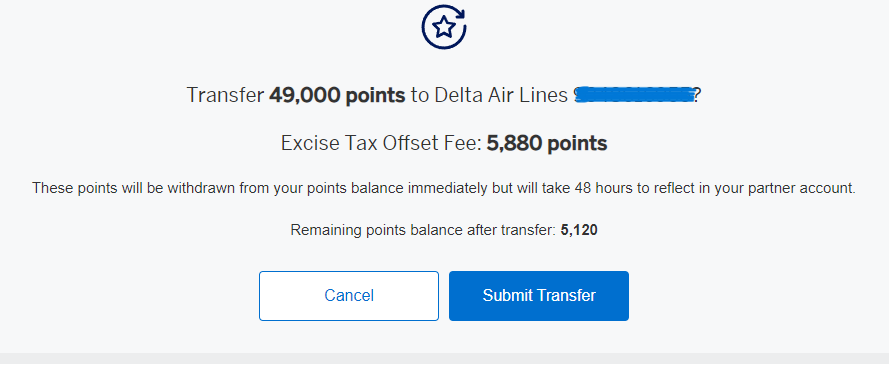

I transferred the difference (of 49,000 points) needed to book 5 award seats on Delta Airlines. I had to first link my American Express and Delta SkyMiles accounts, and was then able to transfer points from the bank to the airline.

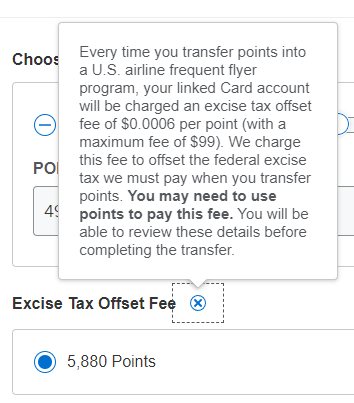

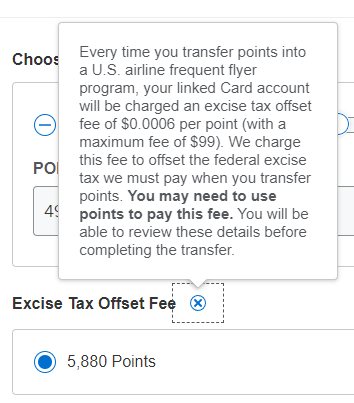

I should add that I was charged a fee – in points – for the transfer of points from American Express Membership Rewards to Delta SkyMiles. This was in addition to needing to transfer 49,000 points from the bank to the airline:

This promotion allowed me to book a spontaneous trip to New York City, for the 5 of us, for just $56! This is my first time to be able to take advantage of such a promotion – I’ll certainly be keeping an eye out for future ones! I should add that with this offer, you had to open a new American Express account. I opened an account for me as my husband already had one open through his Hilton Honors American Express Surpass® Card. Remember, when transferring points from a bank to an airline or hotel travel partner, names on both account need to match. This is my first girls trip with my teenager, and I can’t wait – Big Apple here we come!

[Note: Opening a business checking account does not affect your credit score, because you aren’t dealing with credit. For more in-depth questions, please refer to a financial advisor. Any, and all advice given is from my personal experience and expertise.]

While this promotion may no longer be around, you can check out all the current best credit card offers – so you can continue to earn points and miles from your regular, everyday, normal spend.

Picture: Oregon Coast, July 2023

What did you do after you earned the bonus? Did you transfer your money out? Keep the account open? Close it? Hope that you get another offer?

This is fairly recent, so as of now the account is open. I have kept some money in the account, and in this particular case as a small business owner, plan on using it to help keep business income/expenses separate.