Chase has an unspoken rule known as “5/24.” So what’s the big deal, and why is it so important to keep in mind when it comes to award travel, and the world of award travel?

What is 5/24?

Simply put, Chase’s unspoken “5/24” rule means that you can’t open five or more credit cards across all banks in the last 24 months. Yes that’s right, ALL banks. If you have done so, you cannot get approved for a Chase credit card. Now it’s important to note this isn’t published anywhere on their site; it’s from data points, research, and individuals’ experiences when applying for Chase cards.

Why does it matter?

If you want to get approved for a Chase card, you actually need to be under 5/24. Business cards won’t count towards your 5/24 status, BUT you do need to be under 5/24 to get approved for a Chase business card. If you’re trying to get a credit card from another bank, your current 5/24 status won’t matter; it only matters when you’re trying to get approved for a Chase credit card. (Keep in mind, other banks have their own approval criteria.) All Chase cards, including co-branded cards are subject to this rule. Chase offers some of the best travel credit cards out there, like Chase Sapphire Preferred® Card and Chase Sapphire Reserve®, along with the Chase Ink suite of business cards – so it’s definitely worthwhile to be mindful of your 5/24 status.

Some of my other favorite co-branded cards are the Southwest Rapid Rewards family of cards, and The World of Hyatt Credit Card. These are just some great cards by Chase; point being that – if you want to increase your chances of getting approved for a Chase credit card, knowing your 5/24 status and essentially staying under it, is key.

How to check your 5/24 status

You can check your 5/24 status by getting a hold of your credit report. There are free and paid services through credit bureaus Experian, Credit Karma, TransUnion, and Equifax….

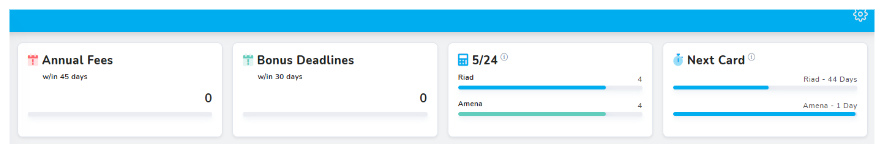

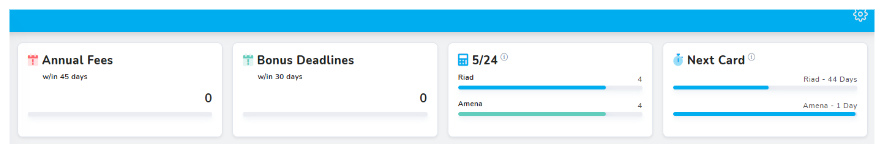

Or you can also download the FREE TravelFreely App – and view all your credit cards there 🙂

TravelFreely helps you keep track of all your credit cards, annual fees and their deadlines, and minimum spends. With a blog, and CardGenie that recommends the next best offers for you – there are plentiful resources to help make your travel more feasible, and keep all your credit cards organized in one place.

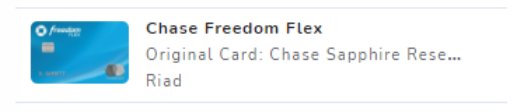

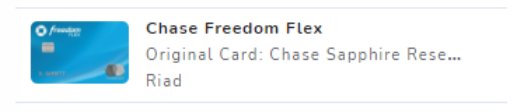

If you downgrade or upgrade a card (don’t recommend upgrading as you’ll miss out on earning the bonus offer) – also known as a product change – that won’t count as getting a new card. I recently had my husband downgrade his Chase Sapphire Reserve Credit Card to Chase Freedom Flex®. (We have the Capital One Venture X Rewards Credit Card, and we don’t need two premium-level cards in the family.) You can also note that in your TravelFreely App:

Bottom Line

Chase Ultimate Rewards are crucial to your award travel strategy. Don’t try to game or beat the system – you could lose your Chase accounts and/or chances of getting approved for future cards. If you’re just starting out in your points and miles journey, cards that earn you Chase Ultimate Rewards are the place to start – more specifically, the Chase Sapphire Preferred is a great starter, and staple card, for your wallet. With the right strategy in place, and being mindful of your 5/24, you can continue to use Chase Ultimate Rewards to help achieve your travel goals and dreams!

[…] our family’s favorites, we love earning Chase points when and how we can. Chase also has their unspoken 5/24 rule, so keeping that in mind – it’s good to apply for Chase cards first, over others as […]

[…] because well, there’s naturally increased expenses this time of year! While Chase has stricter guidelines when it comes to their card approvals – play your strategy right – and you’ll be on […]

[…] the strictest rules. This is why when applying for credit cards, you should be mindful of your 5/24 status, and go for Chase credit cards as, and when feasible. There are two amazing offers right now on […]

[…] a new card. This app is free to use, and shows all of our cards, when annual fees are due, our 5/24 status, and we can even mark when we hit a signup bonus on a card. Along with that, I personally add […]