So you got a card (or two), earned the miles, and booked the trip? Great! But what’s behind all that? What do you need to do when you aren’t traveling, or don’t have an upcoming trip? Getting the right cards and using all the travel tricks to book a trip on points/miles is important. But there’s more to it than that.

If you are working on a sign up bonus for a card, then you’re probably using that card for the majority of your expenses until you meet the minimum spend. Maybe you just came back from a trip. Maybe you have no future trip in mind. Whatever the case may be, it’s those conscious, consistent decisions that you are making regularly that help define future award travel opportunities.

1 – Use the right credit card (or two, or three) for all your expenses

I’m writing this in the midst of another back-to-school season for my older two children. I know, where did the summer go? As you can imagine, we were shopping for uniforms, school supplies, and additional miscellaneous needed items. We currently are working on meeting the minimum spend on my Chase Ink Business Preferred® Credit Card. So that’s the card we charged all school supplies shopping to.

When we are not working on meeting a minimum spend, we use my Chase Sapphire Preferred® Card for the majority, if not all of our monthly expenses. (We also use my husband’s Capital One Venture X Rewards Credit Card for some recurring monthly bills.)

2 – Use online shopping portals

Banks and airlines have shopping portals where you can make purchases from stores that you are probably already frequenting. Basically you’re shopping online at all your favorite stores; you’re just going through a bank’s or airline’s shopping portal. By doing so, you maximize your points/miles-earning potential.

My current go-to shopping portal is the American Airlines AAdvantage shopping portal. I want to earn airline miles for purchases that I would have either made in store or online (depends on the purchase). Here are some other portals –

Airline:

Bank:

- Capital One

- Chase

- Barclays

In order to utilize these, you need to have an active credit card account that earns points with the respective bank’s loyalty program.

Another popular shopping portal, Rakuten, earns you cash back or American Express Membership Reward points for your online shopping purchases.

3 – Look out for increased credit card bonus offers

It’s no secret that signing up for a new credit card will reward you with a good chunk of points that you can put towards a future award redemption. For starters, it’s important to understand how you spend, and how you travel. Let me explain.

I love earning Chase Ultimate Rewards for everyday purchases and monthly expenses. So if a new Chase card offer comes out, I will always check if either of us is eligible to apply. I may, or may not, have a particular trip or plan in mind. But I know without a doubt, I will always need Chase points for Southwest Airlines flights, and World of Hyatt hotel stays (both brands are travel partners of the bank).

I should add that I sometimes prioritize the type of points I want to earn over the multiplier (how much I’m earning per $1 spent on the type of purchase: gas, dining, groceries, streaming services). I prefer to have a good stash of a certain type of points, as opposed to points across multiple loyalty programs. I’ve come to understand how to make the most of our monthly spend in line with our family’s travel preferences. (This is years in the game, so it takes time.)

It is important to know your multipliers – that’s how you can truly maximize your points-earning potential. But that’s the beauty in this – you can earn, and redeem, points and miles in ways that work best for YOU!

4 – Check for targeted offers on co-branded cards

Many times you’ll receive targeted offers on co-branded cards you already hold. Make sure to look out for them in your email.

Here’s one I received recently for The World of Hyatt Credit Card:

If I had a trip coming up where this would apply, that would have been great! In this case, I don’t. But it’s always a good idea to check as it’s an easy way to earn points on planned stays.

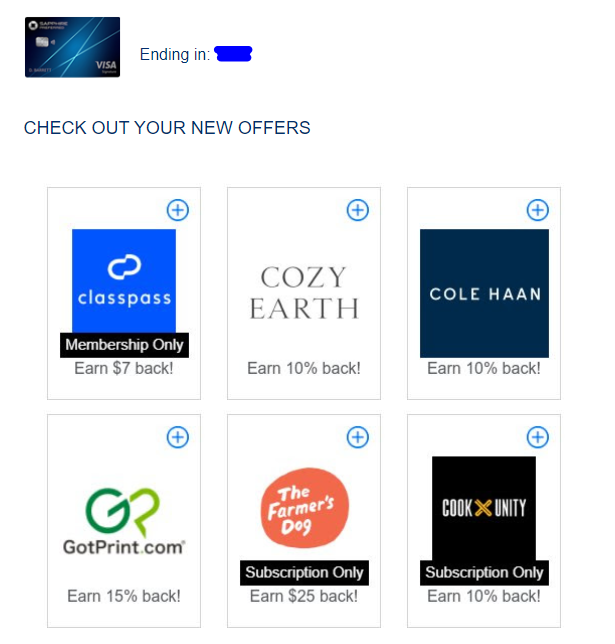

I get offers like this often for my Chase Sapphire Preferred Card:

Now again, as a reminder, do not spend money that you normally wouldn’t because you want to earn more points. That’s not helping you minimize travel costs.

5 – Refer friends and family

When you’re chatting with friends and family about how much you are saving on your next trip, well there’s no doubt they will want to know more! Referral bonuses are an easy way to rack up more points, and it costs nothing to the individual applying. Make sure your loved ones know to use your referral links to apply for a credit card (not all banks have them though).

(If that isn’t an option, your favorite creator’s affiliate links are always available, of course.)

Whether you have a trip in the works or not, focus on using these strategies to continuously earn points and miles. Remember, earning the points needed, and then finding award availability for a trip takes time. When you are ready to make an award redemption, your future self will thank you for planning ahead. Award travel is about working smart, not hard!

Picture: Portland, Oregon – July 2023