Booking in a bank’s travel portal. Ahh, such mixed feelings on this one.

I recently booked flights through Capital One’s travel booking site, and I had to cancel. Now, I’m not going to say don’t ever book flights in a bank’s travel portal because sometimes that’s just what works best. And if you’re using cash, depending on what card you use, you can even earn 5x the points for that purchase. But there are a few things to note when it comes to booking in bank travel portals. Let’s all learn my from my experience.

The Booking

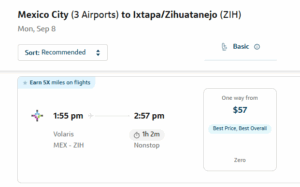

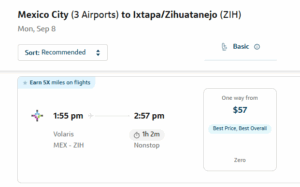

I had booked flights for two through Capital One Travel. More specifically, I had done so because I was wanting to use my annual $300 travel credit that comes with my Capital One Venture X Rewards Credit Card. (Remember, the annual travel credit is applied at checkout.) I had booked flights on Volaris for my husband and I between 2 cities in Mexico for a trip in October.

Then, life happened. It turns out my husband has a work conference the very week I had booked our flights for, and I had to cancel. Oh boy.

Now, What?

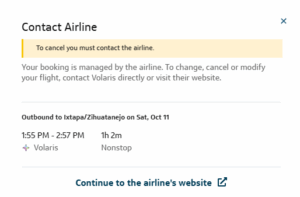

When you book flights in a bank’s travel portal, so for example Chase Travel or Capital One Travel, and you cancel your flights, you’ll generally receive a credit or voucher that’s tied to your name, for the respective airline you had booked on. I know, sure doesn’t make re-booking flights any easier. You’re essentially at the airline’s mercy and discretion, and you’ll see that noted normally in the disclaimers at the time of booking.

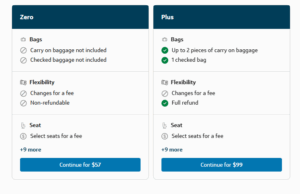

I was aware of this, but no one anticipates for life to happen. I mean, I thought I had covered all my bases prior to booking. As a precaution though, I had booked a ticket that was refundable. But again, that “refund” is generally not a cash refund, and tied to the name and airline on the initial booking. I was also wanting to minimize out-of-pocket costs and cover those flights using my annual $300 travel credit.

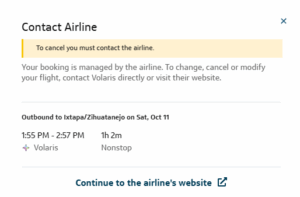

When I went to cancel, it stated I had to call the airline directly. So I did. Customer service has been horrible. While I have been told they have my credit on file, and I can always call and re-book over the phone, I asked for a voucher. This way, I can re-book at my own convenience, on my own time, and online where I don’t need to speak with anyone. I was told multiple times I would receive an e-voucher in my email and I still haven’t.

(We are no longer taking this flight.)

I know I took a chance by booking on this budget airline, and I’ve learned my lesson. Just don’t do it. In addition, don’t do it in a bank’s travel portal. Because it would have been my husband and I traveling this trip, I thought a short flight on a budget airline (that I’ve never flow before with mixed reviews) wouldn’t be the worst idea in the world…..

Not Going Down Without A Fight

I wasn’t going to forgo this annual travel credit so easily, not without a fight. In addition, when I had first spoken with the airline they were quick to charge me $50/person, so $100 total, in cancellation fees. This had not been stated or written anywhere to my knowledge. I sat on it for a few days wondering if I should just accept this almost $400 loss ($270 of the $300 travel credit + $100 in cancellation fees).

But I don’t take no for an answer. Nor can I afford to lose money or travel credits for that matter. So I called Capital One Travel directly.

The representative I spoke with was very helpful. I stated that I hadn’t received the best customer service, and if there was any way they could help me get this credit back. I also asked if there was any chance I could get the credit back, where it’s not tied to anyone or an airline. No promises yet, but that’s what they are working on.

And unfortunately, this is not unusual service for this airline.

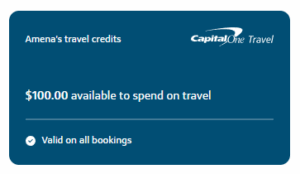

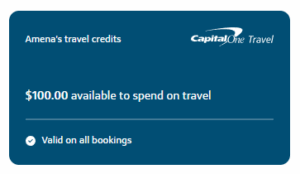

Here’s where it gets a little better. I also mentioned that I had to pay $100 in cancellation fees, but still hadn’t received any online voucher for the flight amount. I was told that as a favor, and for being a Venture X cardholder, I’d receive a one-time $100 travel credit. I saw it in my account right away!

Sure, it wasn’t my original form of payment, but I can defintely use this credit for a future booking!

Should You Book In Bank Travel Portals?

I’m not going to tell you to never book in a bank’s travel portal. Sometimes it works best. If you’re booking on cash, cards like the Chase Sapphire Preferred and Capital One Venture X offer you 5x back for that purchase. If you’re going to book in cash, why not work smart and earn points and/or miles towards future travel?

[Related: Current Best Card Offers]

I booked two sets of one-way flights for our Umrah travel last fall, through Capital One Travel. I wanted to earn 5x back on that expense, and then later use Capital One miles to cover that expense in full – which I did.

So while it’s not all horror stories, I would say make sure you read the disclaimers at the time of booking on what happens if you need to change or cancel your flight at a later time. Depending on the type of ticket you book, you may also be very restricted.

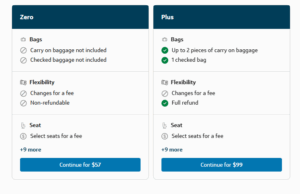

It’s easy to get excited about this one-way, short, cheap flight. But when we look at what all is included, or rather, not included, you may want to book a different ticket.

Note that the “Zero” ticket is very restricting.

In Sum

If you’re booking travel in a bank’s travel portal read the fine print and all disclaimers. Make sure your plans are more than 100% confirmed. Otherwise it’s going to be a hassle and lots of headaches. Also, don’t hesitate to leverage the fact that you’re a (premium) cardholder and use this card often for travel. (This is true for me!) And oh yeah, don’t book on budget airlines. It doesn’t seem worth the risk.