Capital One is my second favorite bank after Chase, and it helped me save just under $3,000 for Umrah travel last year. Yes, I said it – I love my Chase Ultimate Rewards. But diversifying your wallet with cards that earn different types of points and miles is key in award travel. I used Capital One miles to help cover multiple aspects of our 2024 Umrah travel including flights, hotel stays, and even train travel. Here’s how you can do something similar when it comes to booking your future Umrah travel on points and miles.

The Cards

Fee-Free Capital One Cards

There’s currently elevated offers on all 3 cards!

Capital One VentureOne Rewards Credit Card – Earn 20,000 bonus miles + $100 Capital One Travel Credit when you spend $500 in the first three months from account opening. This card earns a straightforward 2x on all purchases.

Capital One Savor Cash Rewards Credit Card – Earn a $200 cash bonus + $100 Capital One Travel credit when you spend $500 in the first three months from account opening. This card is great if food and entertainment are big expenses for you each month. It earns 3% back on dining, entertainment, and grocery stores.

Capital One Quicksilver Cash Rewards Credit Card – Earn a $200 cash bonus + $100 Capital One Travel credit when you spend $500 in the first three months from account opening. This card earns 1.5% back on all purchases, but can be a great option if you’re just starting to open cards, and need to build up your credit score and history.

Note: Even though the last two cards earn cash back, this can be converted to Capital One Miles if you have a miles-earning card (like the ones below).

These fee-free cards can be a great addition to the personal and/or business cards listed below. If your goal is travel rewards, and saving money on Umrah travel, I would get personal and/or business credit cards from Capital One. They’ll offer you more miles in the inital bonus offer, and come with more perks and benefits aimed at travel.

Personal Capital One Cards

Capital One Venture Rewards Credit Card – Earn 75,000 miles after spending $4,000 in the first 3 months. Annual fee is $95. Earn 2x miles on all purchases, and 5x the miles on hotels, vacation rentals and rental cars booked through Capital One Travel.

Capital One Venture X Rewards Credit Card – Earn 75,000 after spending $4,000 in the first 3 months. Annual fee is $395. This card is the premium version of the card above. You earn 10x on hotels and rental cars booked through Capital One Travel, 5x on flights and vacation rentals booked through Capital One Travel, and 2x on all other purchases. You also get benefits such as access to 1,300+ lounges worldwide, including Capital One Lounge locations and Priority Pass lounges (after enrollment), $300 annual travel credit for bookings through Capital One Travel, and up to a $120 credit for Global Entry or TSA PreCheck.

Business Cards from Capital One

Capital One Venture X Business – Earn 150,000 Bonus Miles after spending $30,000 in the first 3 months from account opening. Annual fee is $395. This is the business version of the Capital One Venture X.

Capital One Spark Cash – Earn $1,000 cash back once you spend $10,000 in the first 3 months from account opening. If you hold another Venture Miles – earning credit card like Venture Rewards or Venture X, you can convert the cash back to 150k miles! Yes this minimum spend is high – but note, that if you have the Venture X, you can convert that $1,500. The annual fee is $0 for the first year, then $95. While this is a business card, this is one of the Capital One business cards that will count dowards your 5/24 status.

Capital One Spark Cash Plus – Earn $2,000 cash back after spending $30,000 in the first 3 months. Annual fee is $150. This is also a business card, and will not count towards your 5/24 status. If you hold another Venture Miles – earning credit card like Venture Rewards or Venture X, you can convert the cash back to 200k miles!

Capital One Spark Miles for Business – Earn 50,000 bonus miles after spending $4,500 in the first 3 months. $0 annual fee for the first year, then $95.

(By no means is this a complete list of Capital One cards. I am sharing just some great offers, including ones that are aimed at earning travel rewards.)

[Related: Current Best Card Offers]

Transfer Partners Is Where It’s At

Capital One has 19 transfer partners consisting of 16 airline and 3 hotel programs. Transferring your points and miles to airlines and hotels, and booking travel directly with them, will generally always give you the best value for your travel rewards. (We also never say never around here in the points and miles space.) Here’s some ideas of how you can use their transfer partners to book Umrah travel.

Book A Flight On British Airways

I booked our flights from Dallas to Istanbul on American Airlines. I’d happily do this route again. But what do you do if you don’t have American Airlines miles?

You can book on a partner airline like British Airways. Capital One miles transfer to British Airways; I would just note and compare airfare taxes as British Airways isn’t known for having lower taxes on award tickets.

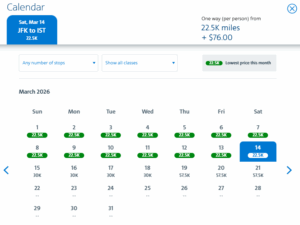

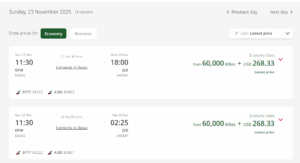

Let’s first do a one-way search from New York (JFK) to Istanbul on the American Airlines website:

I booked 4, roundtrip tickets from Dallas to Istanbul, with one stop, for our November 2024 Umrah trip. It cost me 45k American Airlines miles, roundtrip, plus $150 in taxes, per person. I booked in February of 2024 for travel in November of 2024. I can’t reiterate enough to book as far out as possible, and staying flexible by 1-2 days, respectively if you can.

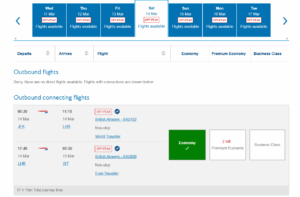

But we don’t have American Airlines miles. So let’s search the British Airways website for award availibility:

You can note the “off-peak” dates. Award rates and taxes per person are slightly higher on British Airways.

Book A Flight On Air France

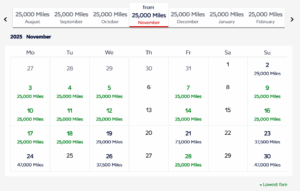

You can book flights to Istanbul, Turkey on Air France’s loyalty program Flying Blue as it is another airline partner of Capital One. I’m searching from my hometown of Dallas to Istanbul – note that these are one-way rates.

Search tip: Leave the dates open and you’ll be able to see a calendar view. I’m looking at one-way rates for November 2025.

Flying Blue is an excellent choice, especially when you’re traveling with a family. Award rates tend to be lower than other programs, though taxes can easily be over $100/person, one way. Flying Blue also has a discount for children ages 2-11; you can receive a 25% discount on award tickets.

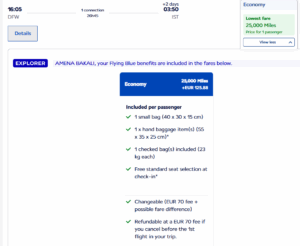

This is what the final points + cash rate would be for a one-way flight from Dallas to Istanbul, for November 2025 travel.

I’m sharing flight options to Istanbul as it’s often a stop in this journey. From Istanbul, it isn’t hard to catch a cheap, short flight into Jeddah.

Book A Flight on Emirates

Emirates isn’t known for lower award rates, and it’s not a part of any of the 3 major airline alliances. But it is known for its airline experiences whether you’re flying economy or on a more luxurious, first class ticket.

Let’s look at one-way rates from Dallas to Jeddah:

Emirates has 4 types of award tickets: Special, Saver, Flex, and Flex Plus. Taxes and fees tend to be higher with Emirates, but lower with its partner airlines. Capital One miles transfer to Emirates at a 1:1 ratio.

I do hope to experience a flight on Emirates at some point in the future!

Book A Flight on Turkish Airlines

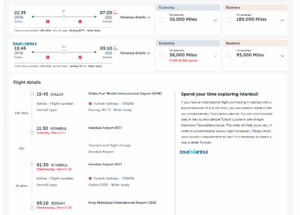

Capital One miles transfer to Turkish Airlines Miles&Smiles program at a 1:1 ratio. Here’s what one-way rates look like for travel in March 2026:

Wow, that’s a lot for just one-way. I actually searched for April & May 2026 travel, and found similar one-way rates. I’d try to book further out in hopes of getting a reduced one-way award rate (no guarantee), if you want to transfer Capital One miles to Turkish Airlines. I even tried changing the departure city to New York city and/or Chicago, but still could not find award rates for less than 58,000 points/one way (atleast for March 2026 timeframe).

Note that certain routes are “touristanbul” routes where you get complimentary service to explore Istanbul. This is a free layover service for all international transfer Turkish Airlines passengers. Layover times need to be between 6-24 hours.

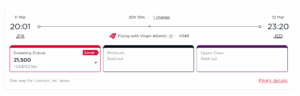

Book A Flight On Virgin Atlantic

Capital One miles transfer to Virgin Red, Virgin’s group-wide rewards club. You can link your Virgin Red account to Virgin Atlantic Flying Club, which is their frequent flyer club. Through Flying Club, you’ll be able to book and redeem award flights.

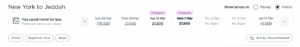

You’ll find the best options on Virgin Atlantic from the East Coast. Let’s search for flights from New York to Jeddah.

I like how you can scroll through dates to find the red label “Saver” options which are their lowest-priced Reward Seats.

Note the stop, and the taxes for this one-way route. Taxes do tend to be higher when flying through London Heathrow airport. But the stop can be a good time to change into your Ihram.

Covering Travel-Related Expenses

Select Capital One cards have a perk where you can use miles to cover eligible, travel-related expenses. Think boutique hotel stays, flights, train tickets, car rentals, and even theme park tickets. While this won’t get you the maximum value from your miles, it allows you to cover those travel expenses that sometimes just can’t be booked directly in points and miles.

Here are the cards that offer this option.

Personal Cards:

Capital One Venture X Rewards Credit Card

Capital One Venture Rewards Credit Card

Capital One VentureOne Rewards Credit Card

Business Cards:

Capital One Venture X Business

Capital One Spark 1.5X Miles Select

Capital One Spark Miles for Business

How To Use This Perk

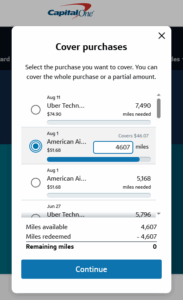

Let’s say you book a boutique hotel in Makkah or Madinah, one that’s not part of a major hotel loyalty program. You didn’t book in points, and you want to cover the cost. You would simply charge the expense, when you book your stay or at the time of checkout, to your respective Capital One card that offers this perk. Afterwards, you have 90 days from the date of expense to cover that eligible expense, in part or in full.

Log into your Capital One account. Select “View Rewards.” Under the “Home” tab, you’ll see “Cover Travel Purchases.” Once you select that, eligible expenses will pop up. You can then use miles to cover expenses in part or in full.

Note that only eligible, travel-related purchases will come up.

In the summer of 2024, I used Capital One miles to cover two car rentals. This perks helps us save more money in our travels, as there are always additional expenses associated with travel. In this season of life, reducing our travel costs takes higher priority than maximizing my points and miles, 100%.

In Sum

- Book as far as out as possible, especially if you need to book for multiple people, during peak travel times. This way you can ensure getting the route and date you want!

- Try to be flexible by a day or two, if you can. I get it. I have two older kids who can’t really afford to miss school anymore. But if you can, you’ll notice sometimes just changing your dates by a day or two, will get you better award avaibility.

- Book one-way routes. You don’t have to book roundtrip. You may find better award availability on different, one-way routes.

- Don’t compare yourself to what others are doing, and booking. (Social media sure doesn’t help!) As someone who travels with her family, during peak travel times, it is nearly impossible to always get the max value for your points and miles. Always be in a points-earning mode, and book in advance. If you do that, you’re already winning at saving money on travel!

Umrah Travel Doesn’t Need To Cost Thousands of Dollars

It’s possible to book an Umrah trip on points and miles, as you would any other trip. Yes, it can be a bit more challenging but it’s certainly possible. And I’m here to show you how it’s done!

You can check out more blog posts here on how to save money on booking Umrah travel.

Umrah is achievable for thousands of dollars less!

For more in-depth information, check out A Guide to Umrah on Points & Miles that I’ve created that walks you through:

- How to search for award flight availability (economy seats) from the U.S., on popular routes to Jeddah & Madinah

- How to search for award flight availability on partner airlines for airlines in the same airline alliance, with video walkthroughs on both

- How to book hotel stays on points, in the 4 major hotel loyalty programs

- What cards are best for hotel stays & flights, as well as thinking through card lifecycles

- How to cover other travel-related costs (such as transportation between the 2 holy cities) that isn’t booked directly using points/miles (like airfare & hotel stays)

- What “free breakfast” means in each of the major hotel loyalty programs, and how to get that perk

- How to stay organized in award travel with the TravelFreely App

I’ve also spent thousands of dollars to go to Umrah with my family, and I know the feeling of planning and saving up. With points and miles, the journey is closer and more attainable than you think.

The comments section below is not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all questions are answered.

Leave a Reply Cancel reply

ADVERTISER DISCLAIMER

HassansonHoliday operates within an affiliate sales network and may earn compensation for directing traffic to partner sites, such as MileValue.com. The arrangement of links on this site may be influenced by this compensation. Please note that not all financial companies or offers may be featured on this site. Terms and conditions apply to American Express benefits and offers, and enrollment may be necessary for certain benefits. Visit americanexpress.com to learn more. For Capital One products mentioned on this page, some benefits are facilitated by Visa or Mastercard and may vary depending on the product. Refer to the respective Guide to Benefits for specific details, as terms and exclusions apply.

EDITORIAL DISCLAIMER

The opinions expressed on this site are solely those of the author and do not reflect the views of any bank, credit card issuer, hotel, airline, or other entity. This content has not been endorsed, reviewed, or approved by any of the entities mentioned. Paragraph