[Edited: 9/10/2024: Card offers have changed since this post was written.]

For the last three years, my husband has had the companion pass and I’ve flown free as his companion on Southwest Airlines, everytime we fly together. We actually didn’t earn the companion pass for 2022. 2020 threw off our travel game and strategy as it did for many, and 2020 and most of 2021 was pretty crazy for us. We built a home, moved 2x, I finished graduate school, and we added a new addition to our family. As we got back into traveling last year, I knew we needed to work towards earning the Companion Pass again – especially since we are now a family of 5 (our toddler’s last free trip was our recent fall break trip to The Bahamas).

And we recently earned it again! So how did we do it? While a common strategy for those in the award travel hobby is to get two Southwest credit cards (one business card, followed by a personal credit card), we’ve been able to meet the number of points required – 125,000 qualifying points to be exact – because my husband travels for work. Everytime he would fly prior to the pandemic – he would charge his work travels to his Southwest Rapid Rewards® Priority Credit Card (the one he had at that time). Now I should add that starting January 1, 2023, you will need 135,000 (so 10k more) qualifying points to earn the highly coveted Companion Pass.

Another difference in our strategy: We have it for the remainder of this year, and all of 2023 (so just over a year). With the two-card trick, you meet all minimum spends in 2023, giving you the Companion Pass for all of 2023 & 2024 (so for almost 2 years). Because my husband travels for work, it’s not too difficult for us to earn it annually with one card. We’ll assess again next year given the increased threshold, how often he may need to travel for work, and if he’s able to always use Southwest for travel bookings.

With his previous job, my husband had a little more freedom as far as how and where to charge his travel expenses. He could book his work travels completely on his own, and then he would be reimbursed afterwards. This meant that he could use any airline/hotel/bank portal of his choice, along with his individual credit card (Hello double dipping! ;)). He would book flights on Southwest Airlines, on his Southwest credit card. Then he would also book hotels through the airline’s site – between using the Southwest portal, and charging on his Southwest card – the points would add up, many times averaging 20-30k points per work trip!

Now, I should add that with corporate travels – there is generally a budget that employees need to stay within, so he also had to be mindful of the cost of a flight and/or a hotel stay. But if he was able to earn more points by booking one hotel over another, that worked in the company’s budget – then that’s what he did. Let me show you an example:

Let’s say he had to travel to Orlando for a work conference. You can see that there is a range of points that can be earned. Ideally, he’d want to book the first hotel that would earn him 12,000 points. But that could be a bit of a stretch, and harder to justify the costs with his company. So he would probably go with the last hotel, still earning a good number of points.

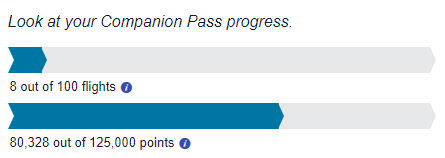

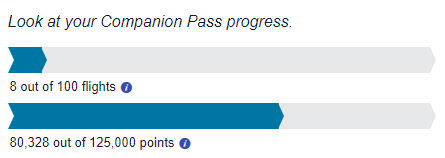

So this is how far we were in our journey to earning the Companion Pass a couple weeks ago:

I recently had him apply for a Southwest Rapid Rewards® Plus Credit Card. Earlier in the spring, I had him close out his existing personal credit card – as you can only have one personal Southwest credit card at a time. I knew that by applying for a personal credit card right around this time, it would help us meet the difference needed to earn the Companion Pass. In our case, do note that we have to meet the minimum spend IN 2022, as it has to all be in one calendar year.

I should also add that he applied when the offer and spend requirement were lower: he had to spend $1,000 in the first 3 months, and then would earn 50,000 bonus points. But wait, that’s not what the current offer is. Offers on all Southwest personal credit cards are currently increased to 75,000 points, after spending $3,000 in the first 3 months. Did I mention we hit our minimum spend rather quickly (due to having to pay off a medical bill), and the Companion Pass hit my husband’s account this past weekend? So did we miss a higher offer by literally a week or two?

No thankfully, we didn’t 😉 I had him call Chase Bank yesterday, and after spending an additional $2,000, they will match the higher 75k points offer and deposit the difference of 25,000 points in his account. I was hesitant to have him do this as it’s Chase Bank – but it’s another reminder that it doesn’t hurt to ask! I’m glad we won’t be missing out on 25,000 Southwest points!

Southwest Companion Pass: Two-Card Trick

If you waited to apply for any of the Southwest cards, you’re in luck! And if you are doing the two-card trick, here’s how you should play it:

1 – Apply for a Southwest® Rapid Rewards® Performance Business Credit Card first. There are two – this one generally has a higher offer on it.

2 – Apply for a Southwest Personal credit card. There are three options. You can choose any of them as you like, as offers are the same on all three, with varying perks and annual fee amounts.

Remember that with the two-card trick, you can apply for cards now, but you need to wait to meet the minimum spend IN 2023 – ALL qualifying points have to be earned in ONE calendar year. Also note that you will need to earn 135,000 qualifying points (as opposed to 125,000). I am considering doing the two-card trick early next year to earn another companion pass for one of our children, so we can have ⅖ in our family fly free (hey now!)

[…] for the Southwest Rapid Rewards Plus Card in late 2022. (We earn the Companion Pass through a one-card hack.) But here was the catch – my husband had had another Southwest Card previously for a good […]

[…] For starters, because my husband travels for work, we can earn the Southwest Companion Pass yearly. It’s what I call effortless effort – the only effort we had to make was to have him apply for a personal card last fall (and obviously meet the minimum spend on that card). That card itself wouldn’t be enough to earn the required number of points obviously, so points earned from personal spend and work trips (prior in the year) helped us meet the rest. Having him close out a card in the spring, gave him enough cushion time to apply for a new personal card in the fall of 2022. You can read more about our one-card hack to earning the Companion Pass (yearly) here. […]