It’s no secret that the Chase Sapphire Preferred® Card is often referred to as a great “starter” card. It’s often recommended to beginners just starting out in points and miles. And for good reason too! I should add it’s not just great for those starting out, but a keeper if you’re looking to continue earning, and redeeming, Chase Ultimate Rewards® for travel.

*When applying through my referral link, please use a new browser window. Don’t log in, if prompted and apply as a guest. That’s how it credits it back to me, appreciate the support!*

The Card & Offer

The Chase Sapphire Preferred® Card has a new offer for 75,000 points after spending $5,000 in the first 3 months. This card has a $95 annual fee.

First things first. Who can get this card? It’s no longer about your 5/24 status and the 48-month rule. Here are new requirements for Chase Sapphire products to keep in mind, from Chase’s website:

“This credit card is unavailable to you if you currently have one open. The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card. We may also consider the number of cards you have opened and closed, as as well as other factors in determining your bonus eligibility.”

Wow, definitely not vague at all.

So what does this mean?

As of June 23, 2025:

- You’re not eligible for the bonus on a personal Sapphire product if you currently have a personal Sapphire card open, have held that exact card before, or received a new cardmember bonus on that exact card.

- It’s now possible to hold both Sapphire products at the same time, but you’d only be eligible for the bonus if you don’t currently have either card.

- The 48-month rule no longer applies. You can’t downgrade a Sapphire product, and then re-apply in hopes of getting the bonus again because it’s been 48 months (which was the previously recommended strategy). (To clarify: You can always downgrade a Sapphire product if you want, but it won’t help you get the welcome offer again just because it’s been over 48 months.)

- These rules don’t apply to the Chase Sapphire Reserve for Business.

How absolute is this? We definitely need more data points, because it states “may not be available to you.” That doesn’t exactly mean a hard no, but we’ll have to wait and see as time goes on.

The good part is that when you apply for a Chase Sapphire card, you’ll get a “pop up” indicating if you’re eligible for the bonus or not. This notice will be done without a hard or soft pull on your credit. You can choose to continue without the bonus, or cancel your application with no impact to your credit score. Do these “once-in-a-lifetime rules” sound familiar? (I’m looking at you American Express.)

Perks & Benefits

For a $95 annual fee, you get a robust package of benefits. Those include, but aren’t limited to:

- 14 airline & hotel transfer partners

- Travel insurance that includes trip cancellation/interruptions, baggage delay, and lost luggage reimbursement

- No foreign transaction fees

- $50 Annual Chase Hotel Credit (must be used through Chase Travel℠)

- 5x the points on Chase Travel℠

- 3x points on dining

- 3x points online grocery purchases, excluding Walmart, Target, and wholesale clubs

- 3x points on select streaming services

- Free Dash Pass – $0 delivery fee and lower service fees on eligible orders for a minimum of 1 year when you activate by December 31, 2027.

- 5x on Peloton purchases

- 5x on Lyft rides through 9/30/2027

- 10% anniversary points boost

There’s also a new “benefit” called Points Boost. Previously, you could get 25% – 50% bonuses for Chase Travel redemptions. Now, for existing cardholders (who applied prior to June 23), you will get “Points Boost” of up to 1.5 cents/point on select hotels and up to 1.75 cents on flights with select airlines. For new cardholders, who applied on or after June 23, you will get Points Boost of up to 1.5 cents/point on select hotels and up to 1.75 cents on flights with select airlines.

Beginner-Friendly Redemptions

When you’re just starting out, transferring points to airline and hotel travel partners can seem overwhelming. Not only can Chase Ultimate Rewards® be transferred to all partners at a 1:1 ratio, redemptions are fairly instant (generally speaking), and more beginner-friendly. Chase is the only bank that includes so many domestic partners:

- Aer Lingus

- Air Canada

- Air France-KLM

- British Airways

- Emirates

- Iberia

- JetBlue

- Singapore

- Southwest

- United

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

For example, transferring Chase Ultimate Rewards® to World of Hyatt makes for very popular redemptions simply because there are no taxes and fees on award stays. I’ve also transferred points for flights to Lisbon on Air France, Tokyo on Virgin Atlantic, and Merida, Mexico on British Airways. They’re honestly my favorite bank points to earn!

Chase Travel℠

You can use your Chase points to book travel in the bank’s portal. You’ll generally always find the best value by transferring them to airline or hotel partners. But, we may all find ourselves booking travel such as a car rental, flight, experiences, hotels – in the bank’s travel portal because that is what works best at the time. The good thing is that you’ll earn 5x the points for that purchase! Do remember to double check if there are price differences between booking direct and booking in the bank’s travel portal. Compare prices and read the fine print on changes and cancellations prior to doing so.

Options to Earn Lots of Chase Points

Chase Sapphire products are just one family of personal cards under an umbrella of Chase credit cards. Here are other card options that earn Chase points:

One thing to note: While you can earn points from multiple Chase cards, you’ll need a Sapphire product to be able to transfer points to airline or hotel travel partners. You can combine points into one of the Sapphire products to redeem for travel, along with individuals in your household. (I had to call the bank the first time to link my Chase accounts with my husband’s. Now, I can easily move points between accounts and cards.)

How To Transfer Points

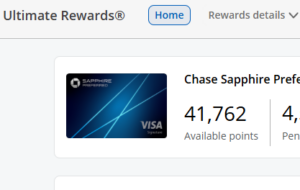

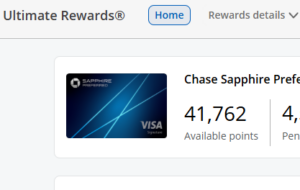

You’ll need to first combine points into a Sapphire card, so for example, the Chase Sapphire Preferred® Card. Log into your account, and go to your Ultimate Rewards®. Under the Rewards details tab, you’ll find “Combine points” once you scroll down.

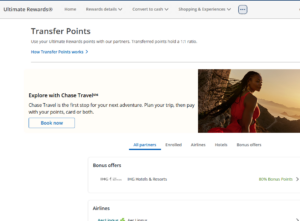

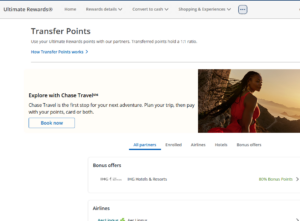

On top of the homepage, you’ll see three dots on the far right. Select them, and scroll down to “transfer points to partners.” This is where you can transfer points to a travel partner. If there’s a transfer bonus to any airline or hotel partner, you’ll see that first thing.

Remember, that names on accounts have to match when transferring bank points to an airline or hotel travel partner. You’ll need to first create free loyalty accounts with the resepective airline or hotel partner you’re trying to transfer points to. Transfers can’t be undone, so only do so with a plan in mind.

In Sum

This card is a staple in my wallet. It’s one card I personally use regularly. If you’re just starting out in award travel and wondering which card to go for – this is the one!