Umrah can definitely be an expensive trip and journey. But in come points and miles for the win. When someone askes me what the “best credit card for travel” is, I have to say there is no one-size-fits-all-trips scenario. Last fall, I booked an Umrah trip for my family for just $500 out-of-pocket. Capital One miles saved me just under $3,000 for this trip. Let’s take a look.

The Cards

Capital One Venture X Credit Card is my favorite and only premium card I hold. You get premium perks such as (but not limited to):

- 10,000 Anniversary Miles

- $300 Annual Travel Credit

- $120 Global Entry or TSA PreCheck Credit

- Acces to 3 different lounge programs (Capital One, Plaza Premium, & Priority Pass)

The offer is currently for 75,000 miles after meeting the minium spend of $4,000 in the first 3 months. The annual fee is $395.

I had my husband get this card back in the winter of 2021, when it first came out with a 100k offer! (I haven’t ever seen that happen again!) I waited until the spring of 2024 to get this card. I wanted to make sure I could justify paying the annual fees for two of these cards. It’s taken us time to adjust to travel as 5, and now 4 years in, we have our rhythm. This card is a keeper, and a staple in each of our wallets.

Capital One Venture Rewards Credit Card is a card I also got last year to help cover additional costs for Umrah that I wasn’t able to book directly in points and miles.

The offer is currently for 75,000 miles after meeting the minium spend of $4,000 in the first 3 months. The annual fee is $95.

Now if there’s one thing I love about Venture cards, it’s the straight forward 2x back on all purchases. So this card can also be a great “starter,” and go-to card for any, and all purchases. For me though, my everyday combination is the Chase Sapphire Preferred + Capital One Venture X when I’m not working on meeting a minimum spend for another card.

Some things to remember:

- You can hold both Capital One Venture cards.

- You can only get approved for one Capital One card every 6 months.

- Capital One can be pretty senstive regarding recent inquiries if you’ve applied for other cards lately. Be strategic about when you apply; many like applying for the Capital One Venture X sooner, than later.

As of 10/29/2025: Capital One has added terms combining Venture & Venture X Cards signup bonus eligibility to 48 months. Here’s what it entails:

- You can get bonuses in upward mobility, not downward. Start with the VentureOne (their no annual fee card), then get the Venture Rewards, followed by the Venture X ($395 annual fee). I personally don’t feel the VentureOne is worth a 5/24 spot though.

- Since 2023, Capital One has had a rule that you can only get a signup bonus every 48 months. The language of the terms have now changed to include Venture X and Venture cards in one family.

Source: Doctor of Credit

Card Application Timeline

- May 2024: I applied for the Capital One Venture X Credit Card

- July 2024: I had my husband apply for the Capital One Venture Rewards Credit Card

- October 2024: I applied for the Capital One Venture Rewards Credit Card

We use the TravelFreely App to keep track of all our card signups and applications. We don’t need to put in any sensitive information and it reminds us of minimum spend, annual fee deadlines, and tracks our 5/24 status for us. And most importantly, it’s FREE!

Breaking Down The Journey

I had booked our roundtrip tickets from Dallas to Istanbul, roundtrip on American Airlines for our November 2024 trip. This meant that one-way flights from Istanbul to Jeddah, and then Madinah back to Istanbul, respectively, had to be booked separately.

I booked flights for 4, in the Capital One Travel portal as I knew I would earn 5x back for that purchase. Select Capital One cards have a perk where you can use miles to cover eligible travel-related expenses. Think expenses such as train travel, boutique hotel stays, theme park tickets, and flights, for example. You have 90 days from the date of expense to use miles to cover an eligible expense (that’s charged to a Capital One card with this feature).

How To Do This: Log into your Capital One account. Under the “Home” tab, you’ll see “Cover Travel Purchases.” Once you select that, eligible expenses will pop up. You can then use miles to cover expenses in partial or full amounts.

- It cost me $556.52 to fly from Istanbul to Jeddah, for 4 people. I used 55,652 Capital One miles to cover this expense.

- It cost me $789.32 to fly from Madinah back to Istanbul, for 4 people. I used 78,932 Capital One miles to cover this expense.

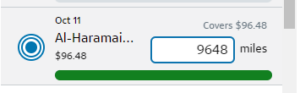

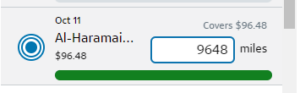

- It cost me $96.48 for our one-way train ride from Makkah to Madinah. I used 9,648 Capital One miles to cover this expenses.

- We stayed at Anwar Al Madinah Movenpick for 4 nights. The cost was $1,332.44. I used 133,244 Capital One miles to cover this expense.

(This is the one-way train tickets cost for 4 people from Makkah to Madinah. This is how it looks in your Capital One account when you try to use miles to cover a purchase.)

It would have cost me $2,774.76 had I paid for all these charges out of pocket. Instead, I used 277,476 Capital One miles to cover all of them, thanks to 3 credit card signup bonuses. We also each had small amounts of Capital One miles in our respective accounts prior to these card signups, to work with. Let’s also not forget about referral bonuses!

Long-Term Strategy

After the 1-year mark, I can downgrade my Capital One Venture Rewards credit card to an eligible, no-fee card option. You need to call in to do this; it can’t be done online. Do not cancel or downgrade a card prior. I’ll most likely have my husband do the same. This can be an easy no-thinking card to use for all purchases, so many love it for their everyday spend!

In Sum

The most ideal way to use your points and miles will generally always be to transfer them to airline and hotel partners, and redeem for travel. But family award travel hits different, and the Capital One family of cards allowed me to cut down on expenses even further this trip. Remember, flights and hotel stays are not the only expenses involved when traveling. Those savings were much needed, as we were buying gifts for our respective families who watched our little one back at home while we were away.

Umrah is achievable for thousands of dollars less! You can check out A Guide to Umrah on Points & Miles that I’ve created that walks you through:

- How to search for award flight availability (economy seats) from the U.S., on popular routes to Jeddah & Madinah

- How to search for award flight availability on partner airlines for airlines in the same airline alliance, with video walkthroughs on both

- How to book hotel stays on points, in the 4 major hotel loyalty programs

- What cards are best for hotel stays & flights, as well as thinking through card lifecycles

- How to cover other travel-related costs (such as transportation between the 2 holy cities) that isn’t booked directly using points/miles (like airfare & hotel stays)

- What “free breakfast” means in each of the major hotel loyalty programs, and how to get that perk

- How to stay organized in award travel with the TravelFreely App

I’ve also spent thousands of dollars to go to Umrah with my family, and I know the feeling of planning and saving up. With points and miles, the journey is closer and more attainable than you think.