[Edited: Card offers do change from time to time, and have so since this post was originally written.]

While standard credit card offers are always there, increased bonus offers come out from time to time. And that’s when you should jump on them 😉 I recently got the AA Advantage Aviator Business Barclays Mastercard that had an increased offer of 80,000 miles. It’s important to note that this is a business card, with no referral or affiliate link. So you can simply google the offer on this card. With a small business, low annual fee ($95), and lower minimum spend than other cards ($2,000) – I knew this offer was too good to pass up!

It never hurts to stock up on AA miles, especially since we want to do more international travel. Shortly after, I also got the Marriot Bonvoy Boundless® Credit Card that comes with 5 free nights (each valued up to 50,000 points, with a total value of 250,000 points) after spending $5,000 in the first 3 months. Now this is a great offer from Marriott, but I was hesitant – would I be able to make use of the offer? And the spend was higher than other cards that generally resonate around the $3k/$4k minimum spend mark.

Well, life sure has a way of life-ing. After two weeks of not having a dishwasher because our current one that was just barely 1 ½ years old broke down on us, and exhausting all options – we had to buy a new dishwasher. I also had dental surgery the same week – and if there’s one thing we know, it’s that dental work is not cheap! I knew these expenses were coming – and so prior to them, I applied to make sure I had enough time to receive the Marriot card in hand, before it was time to spend. (Hubby also had work travel prior to this, so we had already met the minimum spend on the AA Advantage Aviator Business Barclays Mastercard rather quickly, along with regular expenses.)

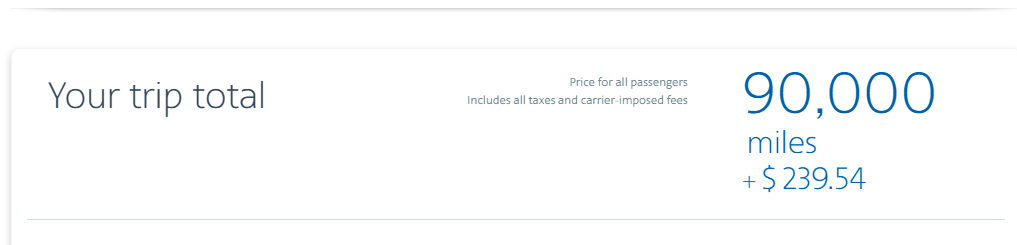

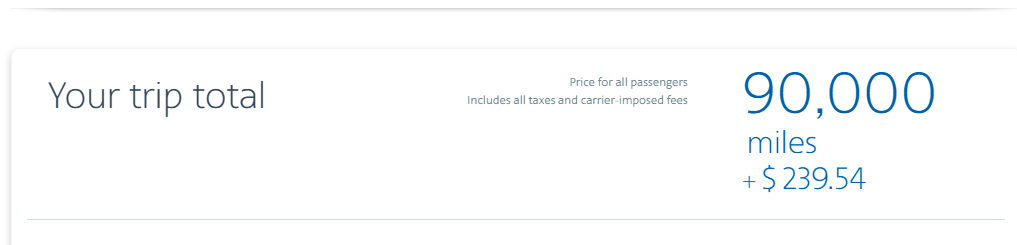

Now for the fun part. As with any award traveler, you either have a plan before you get a card, or you get a card only to come up with a tentative plan shortly after. I honestly had no idea of how I was going to put the points to use that I had earned with either card. But of course, the wheels in my brain were already churning. We had also been talking to family about watching our kids so we could take a parents-only getaway. And after some initial research, I found that I could book 2 tickets to Morrocco with my AA miles. 83,000 miles kicked in (80,000 bonus miles + 3,000 miles from usage); I also had 5,000 miles in my AA account from before. So that put me at 88,000. I had my husband transfer 2,000 miles from his AA account to mine, since the business card was in my name (costs $30) and wa-la – I had the grand total of 90,000 miles I needed to book 2 tickets to Morocco. (It’s 45,000 miles roundtrip/person to Morocco!)

Mind you I am booking five months in advance, but availability was slim for the time period I needed – beginning of December, as that is when our families would be able to watch our 3 children, 2 of them being in school at that time. The more flexible you are, the better award availability you will find – and I was fortunate to find 2 tickets in the specific timeframe I needed, though they are with stops each way. Here’s what I spent on two tickets:

I’ve spent less than $300 in taxes for 2 people; the cash rate was over $3500 for two tickets – no thank you!

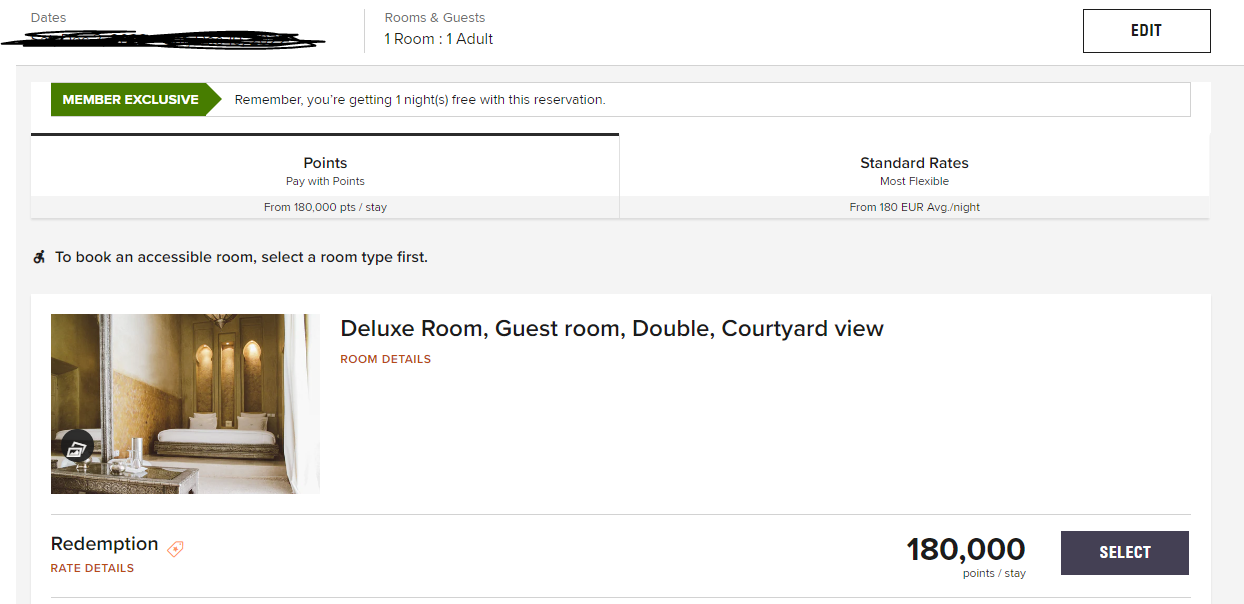

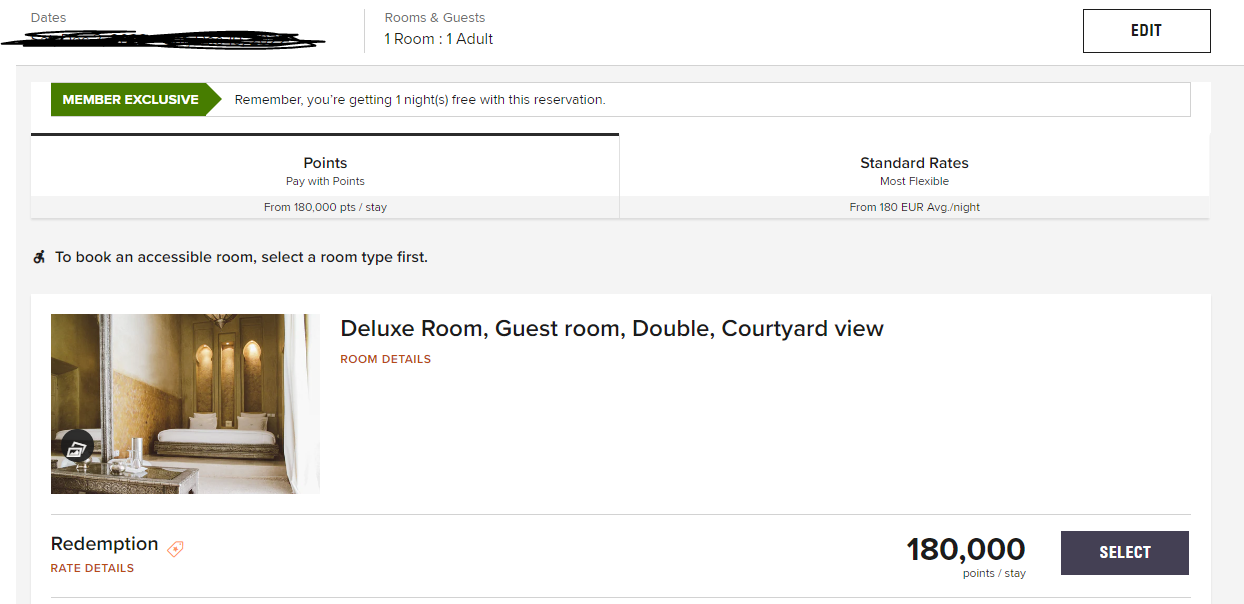

Now what about our hotel? Well, I had been searching, and I fell in love with AnaYela in Marrakesh. It’s a member of Design Hotels, and a gorgeous 300-year old palace that has been transformed to a hotel. If there’s something you should know about me, it’s that I love anything that has to do with old palaces and castles – I love visiting such places and just imagining what life must have been like for inhabitants back then!

We’ll be staying for 7 nights at this beautiful hotel for a total of 180,000 points for the stay, and we couldn’t be more excited!. The hotel also provides complimentary shuttle service to/from the airport which is a plus since we have long hours of travel on both arrival and departure days. The going cash rate for the room came to a total of $1,435, hard pass on that! The best part about all this – this will be our first kid-less vacation in 3 years!

I have to admit if it wasn’t for unplanned life expenses I may not have gotten the Marriott offer. While excellent in its right, I’m always wary of hotel or airline-branded cards because the last thing you want is a stash of points, with no plans of how to use them, along with the possibility that there is an expiration date on your points. I highly suggest having a tentative plan before you apply for such an offer – have some ideas of how those points could be put to good use. It was unfortunate to have to spend a large sum of money in such a short amount of time – but being smart about where we charged these expenses, paid for our much-anticipated couples getaway – in points/miles of course!

[…] expire. Luckily for us, I was able to secure a beautiful hotel in Morocco – for our first kid-less vacation in December – after the new addition to our family in December of 2020. We are really looking forward […]

[…] was different, and frankly speaking, better. Certificates earned from this card are covering our Morocco stay coming up this December. While it’s not one I’m using often right now, when my husband had a […]

[…] Marriott hotels. The catch is that you won’t earn a bonus on your first stay. We have a Marriott stay coming up at the end of this year, but it’s too bad it won’t count towards this […]

[…] husband and I recently came back from Morocco. I used points earned from my Marriott Bonvoy Boundless Credit Card to secure our hotel stay at […]

[…] meet the minimum spend, and this past December covered our hotel stay at Riad AnaYela during our Morocco vacation. You can make unplanned life events work for […]

[…] early December, my husband and I took a kid-less vacation to Morocco. It was our first one after our new addition (who is now somehow 2!). We’re grateful to our […]