American Airlines miles have always been very valuable, and generally speaking, harder to earn for reward flights. American Airlines is part of the Oneworld airline alliance, which allows you to book flights on partner airlines making for some great international redemptions. Not to mention, you can find some low saver redemption rates for U.S. travel too.

And now, we have more options for earning American Airlines miles for reward flights. The Citi ThankYou Rewards program added AAdvantage as its latest 1:1 transfer partner this past summer. If you’re looking to book award flights for Umrah travel, American Airlines is always a great option.

The Routes

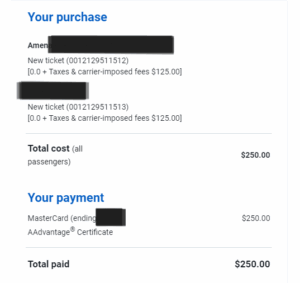

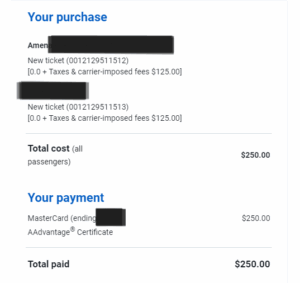

For starters, routes flying through Istanbul or Doha (from the U.S.) are common when it comes to Umrah travel. Let’s take my example from the fall of 2024. I booked flights for four people, flying from Dallas-Forth Worth Airport to Istanbul, Turkey. It cost me $500 in airline taxes for roundtrip flights for the four of us, on American Airlines. This was also our total out-pocket cost for 4 people for booking this Umrah trip (in regards to flights, hotel stays, and one-way transport from Makkah to Madinah).

I booked flights for me and eldest daughter in my American Airlines account, and then flights for my husband and son, in my husband’s account. This is only showing airline taxes for my daughter and I. (This is how the miles were allocated in our respective airline loyalty accounts; we were all on the same flights, to and from Istanbul). I live in an American Airlines hub so this worked well for me. It cost me 45K American Airlines miles + $125/pp in taxes, for a roundtrip flight. (We did have one stop at London Heathrow Airport.) I booked in February 2024 for travel in November 2024 – search and book as early as possible.

I could have booked on Turkish Airlines as well, but I had a good stash of American Airlines miles that was just enough for 4 people (Alhamdhulillah, it was meant to be!). And if we’re being honest here, I’d rather book on American Airlines. Their award calendar and website is more user-friendly, as is their customer service.

But let’s compare routes. Say I want to plan Umrah travel for mid-October. Many of us have kids who have fall break at that time, and it’s not as crowded as the following months.

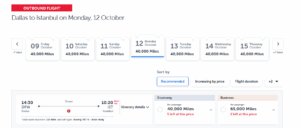

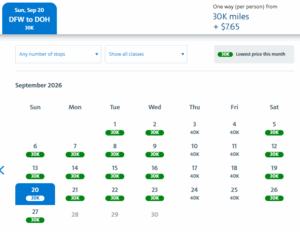

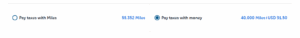

Here’s how it looks on Turkish Airlines. I’m searching one-way routes, from my home airport of DFW.

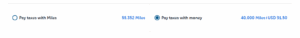

Again, these are one-way routes. Note that you can pay the taxes with additional miles if you so wanted (but I don’t recommend it).

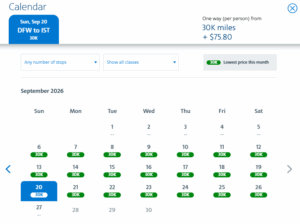

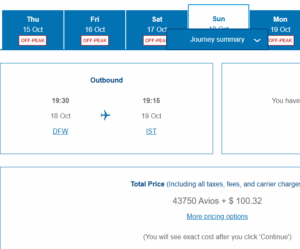

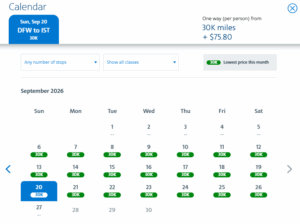

Now, let’s search the same dates on American Airlines. It won’t allow me to search past late September 2026 (at the time of writing), so these are rates for just a few weeks prior to the above search. I love how I can see a monthly calendar view so easily!

So 30K miles + $75.80 pp on American Airlines, and 40K miles + $91.50 pp on Turkish Airlines. American Airlines has better award rates for a similar route, and less taxes. It’s important to always note award rates and taxes for a route.

And yes, award rates do go up and can fluctuate. That’s just the nature of the game – inflation affects points and miles too!

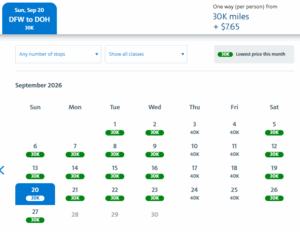

But check this out – if you’d rather fly into Doha (still on American Airlines) taxes are just $7.65 pp!

30K American Airlines miles + $7.65 pp, one-way from DFW to DOH

So as we can see, American Airlines is definitely the winner here.

How To Earn American Airlines Miles

Citi just added a new, co-branded card option making that five cards total.

Card Options that earn American Airlines Miles:

Citi AAdvantage Platinum Select World Elite Mastercard (annual fee is $99)

Citi AAdvantage Globe Mastercard – This is their new addition, and currently has a limited-time offer of 90k American Airlines miles after spending $5k in the first 4 months. The annual fee is $350.

Citi AAdvantage Executive World Elite Mastercard (annual fee is $595)

American Airlines AAdvantage Mile Up Card (no annual fee)

Citi AAdvantage Business World Elite Mastercard ($0 intro annual fee for the first year, then $99) – There’s currently a limited-time offer of 75k miles after spending $5k in the first 5 months.

The Citi AAdvantage Platinum Select World Elite Mastercard and the Citi AAdvantage Business World Elite Mastercard are the cards to usually watch out for as they have elevated offers on them from time to time. The other cards, aside from their no-annual fee card, can also be good options depending upon your loyalty, and how often you fly the airline. Living in an American Airlines hub, I love these miles for international travel!

Eligibility: You can get a Citi AAdvantage card bonus once every 48 months (4 years) for a specific card. You must wait 48 months from the time you received a bonus on a specific Citi AAdvantage card, before being eligible again for another welcome bonus on that same card.

More Card Options Brought To You By Citi

This past summer, in July of 2025, Citi added American Airlines as a 1:1 airline transfer partner. ThankYou Points can now be transferred to AAdvantage miles. This is great as options to earn American Airlines miles was always limited to their Citi co-branded cards.

Card Options that earn Citi ThankYou Points:

Citi Strata Elite Card – This is a new card that currently has a limited-time offer to earn 100K bonus points after spending $6,000 in the first 3 months; annual fee is $595. This is a a new premium card in their lineup of cards with perks that include perks such as hotel benefits, Priority Pass membership, American Airlines Admirals Club lounge access, and up to $120 Global Entry or TSA PreCheck credit.

Citi Strata Premier Card ($95 annual fee)

Citi Strata Card (No annual fee)

I’d suggest the first two cards if your goal is earning travel rewards. (To clarify: the no-annual fee card does earn Citi ThankYou points as well, but I don’t feel it’s worth a 5/24 slot.)

Eligibility – In general, Citi doesn’t limit how many cards you can have. But once you earn a bonus on one of its cards, you’ll have to wait 48 months to earn the welcome bonus again. This doesn’t apply to new applicants for the Citi Strata Elite as it’s a brand-new card. You can only apply for one Citi card (personal or business) every eight days, and you won’t be approved for more than two cards in a 65-day window.

Booking American Airlines Flights on British Airways

Depending on the route and destination, you can often book American Airlines flights on British Airways. This is a good alternative if you don’t have American Airlines miles. You’d need to transfer flexible bank points to British Airways, and then book directly on the British Airways website. Chase, Capital One, and American Express points tranfer to British Airways.

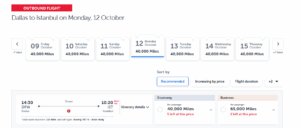

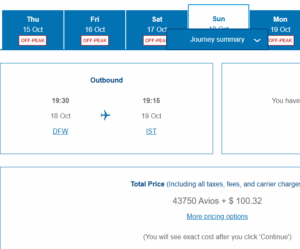

In this case, there aren’t options for booking American Airlines flights through British Airways. Flights booked would be flown by British Airways directly. But if you’re curious, here’s the cost of booking such a route:

It would cost 43,750 Avios + $100.32 pp for a one-way flight from DFW to IST, for travel in October of 2026.

I’d recommend keeping those precious flexible rewards points for better award redemptions (for example, transferring Chase points to World of Hyatt to book a $0 hotel stay at Jabal Omar Hyatt Regency Makkah).

In Sum

I’d happily pick flying American Airlines again, over flying other carriers, when it comes to Umrah travel. And now with more card options that can earn these miles, it just got easier. Remember, you may need to position yourself (also known as booking a positioning flight) to a major city to allow you and your family the best flight routes. Hooray for more options in booking American Airlines award flights!

Umrah is achievable for thousands of dollars less! You can check out A Guide to Umrah on Points & Miles that I’ve created that walks you through:

- How to search for award flight availability (economy seats) from the U.S., on popular routes to Jeddah & Madinah

- How to search for award flight availability on partner airlines for airlines in the same airline alliance, with video walkthroughs on both

- How to book hotel stays on points, in the 4 major hotel loyalty programs

- What cards are best for hotel stays & flights, as well as thinking through card lifecycles

- How to cover other travel-related costs (such as transportation between the 2 holy cities) that isn’t booked directly using points/miles (like airfare & hotel stays)

- What “free breakfast” means in each of the major hotel loyalty programs, and how to get that perk

- How to stay organized in award travel with the TravelFreely App

I’ve also spent thousands of dollars to go to Umrah with my family, and I know the feeling of planning and saving up. With points and miles, the journey is closer and more attainable than you think.